They are wrong.

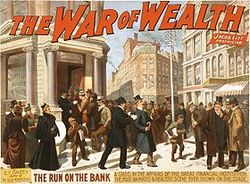

The Panic of 1837 represented the bust of states, which had backed bonds for canals and roads. The U.S. government could not backstop these state bonds, because of politics. The Democratic Party of Andrew Jackson deliberately let the charter for the U.S. Bank to lapse, and thus everyone who had bad paper went bust, both holders and issuers.

George Peabody was, at that time, the main banking representative of the U.S. in London. He was unable to sell American bonds at any price for nearly a decade, even with the aid of partner Junius Morgan. Their bank was only made whole by the California gold strike starting in 1848, which made America's credit good again. (The good news for Peabody was he became rich and America's first philanthropist. His firm became the father of many, under his partner's name. And you may have heard of his partner's son, who became the New York office of the firm — John Pierpont (J.P.) Morgan.

The Panic of 1893 started similarly to the 1837 rout, with the bankruptcy of banks and railroads. But because the U.S. government was mainly supported by tariffs and because money was supported by gold the government was, in fact, running out of money by 1895. Republicans had blamed silver for the panic, winning the 1894 off-year elections, and President Cleveland was forced to borrow $65 million in gold at the usurious rate of 4% interest, from Morgan and partner L.P. Rothschild. As in the previous panic it took another gold rush to really bail us out, this time in the Alaskan Klondike.

Note that when institutions can't pay their bills, hoarders rush first to gold, believing shiny metal maintains its value better than any promise. In the short run they are right. But they were only made right, in the past, by large gold strikes that devalued the market value of gold and made money whole. In the long run only economic activity creates any value. Gold is believed to be a storehouse of this value, but the value itself lies in production capacity.

President Clinton built a bridge to the 21st century, but President Bush detoured it to the 19th. Before we can move forward, many of the issues of the 19th century will have to be legislated again.

Finished a book a while back titled, This Time Is Different: Eight Centuries of Financial Folly by Carmen Reinhart and Kenneth Rogoff.

http://www.amazon.com/This-Time-Different-Centuries-Financial/dp/0691152640/

It’s filled with a lot of comparative data, much of the real numbers beginning in the early 19th century. It demonstrates the various ways countries get into debt and then either repeatedly default or inflate their way out. As long as a government can print its own money, it’s wired to overspend and overreach.

Problem is, I don’t see any new sources for mass job creation. When the wealthy are done buying their second or third yacht and there’s no broad consumer base, i.e., middle class, to power economic demand, no amount of trickery is going to free us. Cancel the debt and tell the banks “No more backstop — the taxpayers are flat broke!”

Finished a book a while back titled, This Time Is Different: Eight Centuries of Financial Folly by Carmen Reinhart and Kenneth Rogoff.

http://www.amazon.com/This-Time-Different-Centuries-Financial/dp/0691152640/

It’s filled with a lot of comparative data, much of the real numbers beginning in the early 19th century. It demonstrates the various ways countries get into debt and then either repeatedly default or inflate their way out. As long as a government can print its own money, it’s wired to overspend and overreach.

Problem is, I don’t see any new sources for mass job creation. When the wealthy are done buying their second or third yacht and there’s no broad consumer base, i.e., middle class, to power economic demand, no amount of trickery is going to free us. Cancel the debt and tell the banks “No more backstop — the taxpayers are flat broke!”

There is a mechanism for mass job creation, and it’s detailed in a post a few up from this one. As renewable energy scales, it produces lots and lots and lots of jobs, along with lots of economic growth.

The tipping point comes when renewable energy can match the cost of fossil fuels, so the value of oil in the ground starts to go down instead of up.

My own estimate for that date is 2016. But in the meantime those who are invested in the space are all employed, and will remain so, and will continue hiring at a brisk pace.

There is a mechanism for mass job creation, and it’s detailed in a post a few up from this one. As renewable energy scales, it produces lots and lots and lots of jobs, along with lots of economic growth.

The tipping point comes when renewable energy can match the cost of fossil fuels, so the value of oil in the ground starts to go down instead of up.

My own estimate for that date is 2016. But in the meantime those who are invested in the space are all employed, and will remain so, and will continue hiring at a brisk pace.