Think of this as Volume 11, Number 38 of A-Clue.com, the online newsletter I’ve written since 1997. Enjoy.

In all the reporting on the unwinding of Big Shitpile one question is almost never asked.

Where is Warren Buffett?

So far Buffett’s Berkshire Hathaway has made just two moves:

- It got out of the business of insuring bank deposits over $100,000.

- Its Mid-American Energy unit bought a competing energy company, Constellation Energy.

This may be the most frightening news you see all week. The world’s premier value investor does not see value, even at current levels. Buffett has not been in discussions about buying Morgan Stanley, Goldman Sachs, AIG, or any other troubled company.

It’s not like he doesn’t know the business. Berkshire Hathaway owns GEICO, originally the GE Insurance Company, built by the father of the doofus who created Overstock.Com. He knows housing, too.

But he is not stepping in. Yet. He is calmly watching his own company’s value drop modestly (12.5% so far this year), and he has not been an innocent lamb, either. Executives with his General Reinsurance unit are in the process of being sentenced to prison for misleading investors about AIG.

Despite all this, Warren Buffett’s is the only gilt-edge name we have in American business, the only man whose credibility exceeds that of his fortune (and the fortune is $50 billion) by many miles.

Why should Warren Buffett step in, and how, and when? History offers an answer. When we hit bottom.

We have been down this road before. Several times.

Before the SEC was created, during the New Deal, financial panics were a regular feature of American life. What made the 1929 stock market crash so harsh was that there was no one who could, or would, step in and call a halt to it.

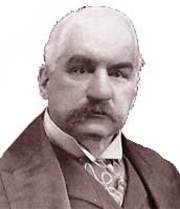

Before that, there was. His name was J.P. Morgan.

Morgan was often referenced by Populists as the ultimate predatory capitalist. His mission was to maintain the calm and professionalism of markets, by consolidating industries, preserving capital, and taking a piece of everything. That’s why we still have both Morgan Stanley and JP Morgan Chase — J.P. Morgan was good at his job.

His most famous (or infamous) move was the 1895 Gold Bond, which saved the U.S. itself from default. But he also intervened personally in the 1907 panic, putting together a rescue package for the leading Wall Street firms, ending the run which threatened to do what it finally did in 1929, when he was no longer with us.

Morgan did nothing out of the goodness of his heart. He was as hard-hearted a capitalist as you could find. He moved in when he saw bargains, when there was money to be made. And when he did, he called the bottom. He stopped the rot.

That’s what Warren Buffett needs to do. He needs to step in and stop the rot. At some point everything has a price, and every market a bottom. Maybe we have not reached it yet.

But I’m not putting a dime of money to work until Warren Buffett calls that bottom. And neither should you.

Great points. I too am watching Warren carefully. Personally, I think he may be waiting to get Goldman at a fire sale price. Now that’s a company worth holding long term:

http://chrisyeh.blogspot.com/2008/09/brk-gs.html

Great points. I too am watching Warren carefully. Personally, I think he may be waiting to get Goldman at a fire sale price. Now that’s a company worth holding long term:

http://chrisyeh.blogspot.com/2008/09/brk-gs.html