There is always a next crash.

I can’t answer the first question, but I can answer the second.

It will be private equity.

Private equity has been taking over the world for the last 40 years. It arbitrates against financial regulations by design. The idea is that people who invest in such a fund are guilty of wealth and, thus, can afford to take a loss.

But are they? Any loss, taken in any market, results in some panic selling. We see it in every crash.

The problem is that there’s now more private equity running around than public equity. The canary in that coal mine is the banking business.

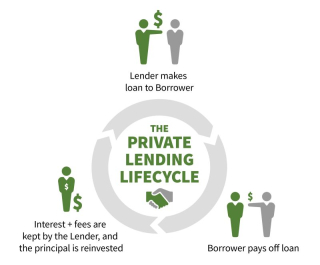

Private lending has exploded in recent years. This is a $1.5 trillion business that’s crowding out banks. This was a $1 trillion business just two years ago. It’s growing that fast.

The excuse here, as with everything else involving private equity, is that we’re dealing with “high net worth individuals.” Unlike you and me, supposedly, they can handle it. They’re big boys and girls.

But are they really?

Even rich people panic in the face of big losses, and big losses are inevitable in an unstable world. That’s why we have regulations. To see banks “crowded out” by private lenders is to see regulated entities crowded out by unregulated ones. It’s banking as it was in 1873, 1893 and 1907, when Wall Street panics broke honest bank depositors.

But it’s going to happen. I don’t see a way around it. Because no one is even raising the alarm. Instead, they want bank regulations loosened to compete. That’s precisely the wrong approach. We need regulations on private equity strengthened, and we need that to be done on a global scale.