Baby Boomers. My people.

I was born in 1955. That was the center of the Baby Boom for males. My dear wife was born two years later, its center for females.

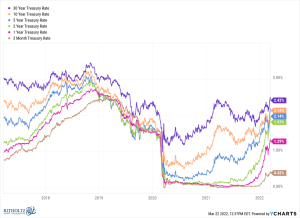

Like other Boomers we’ve had our share of problems. Housing was even more unaffordable when we bought our place in 1984 than it is today. The interest rate on our mortgage was 12%. We’ve lived through three stock market collapses, and dozens of mini-crashes. We’ve had to constantly adjust as Moore’s Law eliminated jobs. Even white collar workers were not safe.

Now, after a decade of free money, money costs money again. It’s happening just in time.

When you’re young you take big risks to build a nest egg. When you’re older you reduce risks to generate income. Inflation has arrived just in time.

It’s also unlikely to last. Gas prices and used car prices are already coming down. Supply chains are starting to unsnarl. Moore’s Law will continue doing its work of cutting costs, and software will keep increasing productivity. We can harvest abundant energy from the Sun and the wind, cheaper than anything we can pull out of the ground and burn. We are likely to live over a decade longer, with more good health and comfort, than our parents ever dreamt of.

The extra income will be welcome.