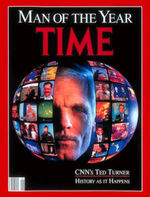

Ted Turner was a brilliant man, a great entrepreneur, and a philanthropist, who was hosed by AOL to the point where he had to renege on some of his greatest philanthropic achievements. That’s why he lives as a virtual recluse, a Citizen Kane of the 21st Century.

Oh, don’t feel too sorry for Ted. He’s doing OK. His ranches are profitable. But imagine what he could have done if he really had that $10 billion he thought he had after the 2000 Time-AOL merger was announced. It’s quite a comedown. Which is why you don’t see him much in public these days. He is usually portrayed as a flake.

I worry that the same thing may now happen to another multi-billionaire, Bill Gates.

Right now Microsoft is selling at $30/share, a P/E of 25. It retains a near-monopoly in operating systems with Windows and an even better position in basic applications with Office.

But everything else is a disaster:

- They’re still losing money on the XBox.

- When was the last time you heard about MSN?

- Zune?

Then there are the growing competitive threats:

- Linux scales better on servers, and that’s where the enterprise market is moving.

- IDC predicts Windows Vista will face unprecedented push-back for its anti-piracy features.

- Apple can now supply as many PCs as folks want to buy.

- OpenOffice is free, while Office costs $500, and buyers are waiting longer-and-longer between replacements.

All this spells growing trouble. It has been years since people thought of Microsoft as a "big time" brand. Its control over the channel would shake further if, say, Dell or H-P rolled out a complete Desktop Linux solution, complete with applications. IBM continues moving from strength-to-strength, putting high-end software revenues at further risk.

Microsoft has hired thousands of "high bandwidth" people from top schools over the last decade, but it has very little to show for it all. The biggest mistake has been a lack of entrepreneurial passion — it’s much easier to say no than yes at today’s Microsoft. Elvis has left the building, and Steve Ballmer is not Elvis. He’s not even an Elvis impersonator.

Microsoft still has over $29 billion in cash, supporting a market cap of $300 billion. But its revenue growth rate is falling, and short interest is up to 144 million shares.

You want to pay an above-market P/E for that? A market-average P/E would bring the share price to about $20. And when the bloom comes off the rose, the pace of implosion can easily accelerate.

Microsoft today is seriously in need of re-invention. It needs an entrepreneur to cut wasteful spending and point it in a new direction. Maybe into corporate services, where IBM has hardly any real competition.

I hope that doesn’t happen now, for Bill’s sake and the world’s sake. But it could.