I’ve been noodling on the SPAC problem for months now, wondering what’s wrong with them. Only recently has the answer come to me.

I’ve been noodling on the SPAC problem for months now, wondering what’s wrong with them. Only recently has the answer come to me.

Special Purpose Acquisition Companies (SPACs) are designed to take private companies public before they’re ready for the public market. That is, the SPAC buys what’s basically a venture company, then sells stock in the venture to the public.

SPACs don’t have profits or even sales to justify their valuations. What they have is the sponsor’s word, and the CEO’s presentation. These are carefully stage-managed, as though public investors were buying into a venture fund. Of course, small investors can’t buy into venture funds. We’re not accredited. We can’t guarantee that if the venture goes bust, we won’t be hurt. That’s what being accredited means.

This all became clear in writing about two recent SPACs, Hyliion (HYLN) and Luminar (LAZR). These are both plays in the electric-autonomous car game. Replace oil with electricity, replace drivers with computers, change the world. In the jargon of the time, disrupt.

This all became clear in writing about two recent SPACs, Hyliion (HYLN) and Luminar (LAZR). These are both plays in the electric-autonomous car game. Replace oil with electricity, replace drivers with computers, change the world. In the jargon of the time, disrupt.

As you may have noticed, the car world ain’t changed. There are Teslas, Leafs, and Priuses on the roads. But most of what investors are buying today are smoke and mirrors. It’s hot air.

Hyliion wants to turn 18-wheeler tractor-trailers electric. But it knows that can’t happen all at once. The plan is to retrofit them with an electric drive train. Fleet owners can still burn diesel, or compressed natural gas, but their fleets will be ready when electricity is cheap enough, and plentiful enough, for that to make sense. Hyliion has booked no revenue. But the company is worth $1.5 billion. The CEO is Thomas Healy, 28. He was said to have “won the lottery” a SPAC called Tortoise Acquisition took it public in 2019. A few months ago, Hyliion was worth $6 billion. A short-seller blew the whistle last October and, after he and his friends were squeezed out, someone read the report and the stock crashed.

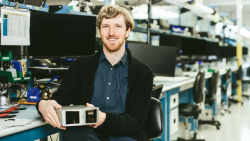

Luminar wants to use Light Direction and Ranging (Lidar) to give cars computerized “eyes” that will let them see what’s around them and avoid accidents. It’s the key ingredient in making cars semi-autonomous. Luminar had $14 million in revenue last year. Its market cap is almost $7.3 billion. The boss at Luminar, Austin Russell, is even younger. He’s 26. He was taken public by a SPAC called Gores Metropoulos. Citron Research, another short-seller, has the skinny on them. So far as I know Russell is still a billionaire.

Luminar wants to use Light Direction and Ranging (Lidar) to give cars computerized “eyes” that will let them see what’s around them and avoid accidents. It’s the key ingredient in making cars semi-autonomous. Luminar had $14 million in revenue last year. Its market cap is almost $7.3 billion. The boss at Luminar, Austin Russell, is even younger. He’s 26. He was taken public by a SPAC called Gores Metropoulos. Citron Research, another short-seller, has the skinny on them. So far as I know Russell is still a billionaire.

SPACs aren’t like venture deals. What happens first is that the sponsor hands himself a ton of stock. He then gets his buddies to pony up cash for what’s called Private Investment in Public Equity (PIPE). The founder also gets a cut – a very, very fat cut. All these guys are in well ahead of the public. You pay $X and get 1 share. They got their shares free, or nearly free, long before you showed up. It’s like venture funding that assumes success. To win anything the public investor needs to win 10x.

The SPAC sponsor is successful by having an “exit,” convincing someone to go public and buying them in the public market. The company is successful without accomplishing anything. You’re left holding the bag.

It’s the small public investor who SOL — Shit Outta Luck

The SPAC nonsense makes irrelevant all the protections built by the Securities and Exchange Commission (SEC) since its founding during the Great Depression. All it took to say “game over” on SPACs was a letter from the agency’s accountants, saying sponsors should be responsible for what they say, and questioning whether the “warrants” (options to buy) stock in the PIPE might be classed as loans, not assets.

The SPAC game is, in the end, just one of dozens of scams launched during the Trump Administration against everyone who wasn’t in on the game, everyone who wasn’t an insider. It won’t do any good to throw Chamath in jail, or see Healy go broke. The damage is done. The credibility of the public markets has taken the hit.

We’re going to find that it’s just one of many hits taken by the markets in the last few years.