They worry about commodity prices. They worry about gas. They worry especially about wages.

Inflation might be high this year. There’s enormous pent-up demand from the pandemic. There’s a tremendous amount of spare cash running around. You can feel it on the roads, traffic jams and people driving like maniacs. Restaurant wait times, and check sizes, are up.

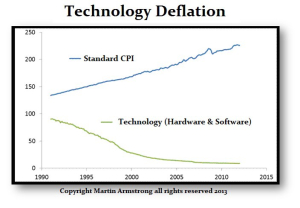

But as usual the worriers are fighting the last war. Inflation is no longer a threat as it was in the 1970s. Today’s threat is deflation.

In this century, these worries have moved into the general economy. Millions of jobs have disappeared, replaced by computers. Middle managers, salesmen, brokers, travel agents. Good middle class careers have been blown away because clouds and devices can do the same things perfectly well.

Tech creates productivity. At first it means getting more work done in less time. Then it means getting more done with fewer people. Once you’re replaced by a computer you need to find something else to do.

Deflation is worse than inflation. When prices go up, you spend ahead of them. Hyper-inflation can destroy your life savings, render it worthless. But deflation ends your job, your career. It leaves you penniless.

All this was proven a decade ago. When the economy crashed, the Federal Reserve flooded the market with money. Washington passed a trillion-dollar stimulus. Was there hyperinflation? No. The markets came back. Just as they started to do in the 1930s, when government spending was deployed against manufacturing productivity.

In his last letter to shareholders, outgoing Amazon.com CEO Jeff Bezos estimated consumers saved $165 billion last year by using Amazon instead of going to stores. I believe it. When told we need something I can order it in minutes and go back to my day. It arrives a day or two later for no more than I would have spent at a store. That’s productivity. That’s saving.

It’s also deflation. Every online merchant creates the same savings as Amazon. Many create more. If you can buy a car online, you’re saving days and weeks. If you can buy a house online, you’re saving weeks and months. You’re not going back to the old days. You’re getting some extra sleep.

There’s a reason the areas where tech dominates the economy have turned to the economic left. They need new demand, new things to do. Whether those are private or public goods we’re competing to sell doesn’t matter. We need demand, or our falling costs will destroy the economy. The Great Depression is the threat, not Whipping Inflation Now.

Technology will clean up inflation, with new materials, new business processes, new automation. I don’t have to drive to the store, and my wife doesn’t have to drive to work. Find new things for our kids to do.