But the transfer wasn’t done by Donald Trump.

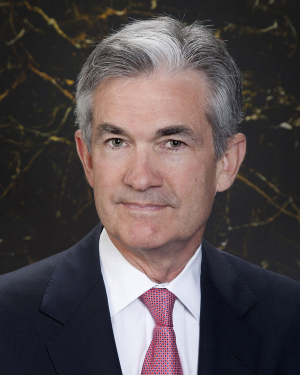

It was done by Federal Reserve chair Jay Powell.

The $2.3 trillion the Federal Reserve created out of whole cloth in March went almost entirely to people who already had money.

Powell bailed out every bad and stupid bet the market had made. He bailed out the airlines. He bailed out the cruise lines. He bailed out the casinos and the oil companies.

Capitalism is supposed to be about private risks that can go bad, and risks that work fueling the greater good. At a stroke, Powell turned that truth on its head, removing the risk markets are built to protect, and socializing it. The vast majority of people were told to pay their rent and buy food while tens of millions were losing their jobs.

Carnival Cruise Lines should be out of business. They bought back stock and handed out big dividends when times were good. Technically they’re not even an American company. While they have offices in Miami, they’re legally run out of tax havens. But if you bought Carnival when I said sell, on May 15, you’re up 50%. That’s because, after Powell’s actions, Carnival was able to borrow $6 billion from investors desperate for yield, something that was only possible because of the Fed’s money creation efforts.

All assets are now overpriced. Amazon.Com is a great company. I own some shares for my retirement. But is it worth 126 times earnings? Is any stock? The average S&P stock today is worth 22.4 times earnings, and this before the earnings disappear under the pandemic. The chart on this number will soon look like 2008, when the average PE went to 65 because there was no E to support the P.

When the economy comes back, middle class people are going to be outbid for everything. The wealth of the country’s billionaires rose by $434 billion during the lockdown.

Powell turned a capitalist society into a feudal one at a stroke. We’re 18th century France, not Hamilton’s America. This is class warfare on an epic scale.

But it’s not over.

Over the next few months, as the reality of the fall COVID-19 wave becomes clear, and the victory of Democrats in November grows imminent, money Powell poured into the markets will be lost. Only the debt he created will remain. You can’t grow assets on the back of nothing. Money only matters when it’s being exchanged for goods and services.

By the time Trump loses, the financial cupboard will be bare. The federal debt will be unmanageable. The U.S. dollar will be in free fall. The age of China will have begun, and there will be nothing Joe Biden or Jeff Bezos will be able to do to stop it.

All because of Jay Powell.