Nearly a decade ago, having been tossed to the curb by ZDNet for calling out a “privacy” lobbyist as an industry shill, I changed the headline of this blog to focus on renewable energy.

Nearly a decade ago, having been tossed to the curb by ZDNet for calling out a “privacy” lobbyist as an industry shill, I changed the headline of this blog to focus on renewable energy.

“There is no energy shortage. The sun shines, the wind blows, the tides roll, we live on a molten rock.”

Tidal and geothermal energy have yet to make major contributions to our energy mix, but the Sun does indeed shine and the wind does indeed blow. More important is the cheapest form of renewable energy, efficiency, and which is always before us.

Today, U.S. energy demand is just passing its year 2000 peak. This is true despite Gross Domestic Product, the economy’s production of goods and services, rising from $13.131 trillion in 2000 to last year’s $18.566 trillion. That’s 41% more economic activity with no increase in energy use.

Computing has contributed. In 2004 Intel switched entirely to low-power designs, after finding that “desktop” designs were frying its chips. Computing clouds, led by Google, found they could turn the “waste” heat they were generating into useful energy. Everything today runs on the 20th century equivalent of batteries.

Computing has contributed. In 2004 Intel switched entirely to low-power designs, after finding that “desktop” designs were frying its chips. Computing clouds, led by Google, found they could turn the “waste” heat they were generating into useful energy. Everything today runs on the 20th century equivalent of batteries.

But there have been other breakthroughs. LED light bulbs are one such breakthrough. Flat panel screens cost less energy to run than the picture tubes they replace. The designs of all engines have improved, and electric cars have taken out demand for oil.

The cost of solar power, meanwhile, has been cut by nearly two-thirds.

Most solar energy costs today are “soft costs,” things like permitting and installation. The cost of panels themselves have declined 12% per year through this decade and should keep declining 7% per year through the next decade.

One of the first people I connected with after joining the energy beat was another Rice University alum who was boosting the idea of West Texas as a wind power corridor. The heart of oil country is now a wind farming colossus. Fossil fuel lobbyists have targeted the new industry’s tax incentives, but wind now generates over 17% of the state’s power, and when supplies peak electricity becomes free. There’s no turning back.

Fossil fuel activists are now fighting a rear-guard action against trends they can’t change. They can eliminate the subsidies for renewables, they can claim that storage costs mean such energy isn’t cheaper, and they can change the way wholesale markets work to advantage themselves

It doesn’t matter. Costs for storage have plunged 80% this decade. That’s without any new technology.

But they will. Bladeless wind turbines will find niches in cities. New solar technologies will find entrepreneurs and venture capital willing to bet on them. It’s just taking longer than I anticipated because of the success we’ve had scaling previous generations.

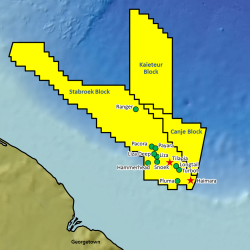

Oilmen have been taking advantage of technology too.

This makes 2019 the last dance of the oilpatch. The Trump Administration has all its cards on oil, but economics and technology say they’re going to lose. If you can’t push oil past $100 per barrel with Saudis and Iran in a state of war, Venezuela in turmoil, with Russia having its oil sabotaged, and with the U.S. government completely in the tank for the industry in terms of policy, it can’t be done. All that pressure will be unwound at the next election.

What will follow is something I predicted back in 2010. Houston, the city where I went to college, the city where I met my wife, is headed down that long, dark tunnel that Detroit is only now starting to exit. There is no business other than oil in Houston. They can talk all they want about software and health care, but there is nothing to pick up the slack from oil and gas.

Besides, oil and gas have made the ice caps melt and Houston is just 50 feet above sea level. It’s going to be one of the biggest stories of the next decade.

Very informative indeed.

Very informative indeed.