The 2008 crash brought in Barack Obama, and the age we’re now living in. But like most people (including me), he thought the crash and his election meant the end of the crisis, not its beginning.

We’ve all learned better now.

One reason is that the 2008 collapse, and its quick resolution, didn’t drive home the lesson about speculation, and how man-made bubbles can cause enormous hurt when they pop, as they always do. The “Helicopter Ben” Bernanke solution of dropping money on the banks, replacing the losses, then regulating the banks’ use of the funds, only took the banks out of the equation during the next bubble.

The cycle of crisis, recovery, anti-thesis, and excess accelerated, as change does in the age of Moore’s Law. By 2016 the markets were ready for a new period of excess.

So, people are paying big money for nothing. Bitcoin is nothing. It’s an encryption key, tied to a technology as revolutionary as the Internet itself. But that blockchain technology is as immature today as the Web was in 1999.

All assets are overpriced. When the average stock in the Standard & Poor’s 500 average is selling for 25 times earnings, stocks are overpriced. When housing is completely unaffordable to people of median income, as either owners and renters, it’s overpriced. Prices need to fall.

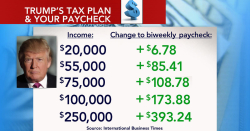

What is the political impact of all that? Trump is at 30% approval, and his Congress is at 30%, with the stock market and Bitcoin prices at record levels. Guess what happens when the economy tanks?

Every political cycle runs against the backdrop of economic and market forces. This one is also running against the results of rapid change and longer lifespans. The people running our society all have memories of the time before Moore’s Law became a force in our lives.

I am just one example.

Anyway, I remember the shed behind his house. It was a wonderland of mechanical measurement. He had a slide rule packed in a leather case, all the tools needed to draw engineering diagrams by hand, even an oscilloscope. At that time my dad was the techie in our family. He owned a radio and TV repair shop in Massapequa where all the equipment ran off tubes.

One day, when I was about 8, an old man (younger than I am now) came into my dad’s shop holding a paper bag. Inside the bag he had a collection of transistors, “pnp silicon’, and “npn germanium” were among the phrases he used as he pulled them out, one by one, and quoted prices. I remember that day like it was yesterday. Time stopped. I got a tingle inside, the kind you get when you’re watching a magic trick performed.

I didn’t understand transistors. I couldn’t tell when one broke. In fact, it didn’t break, and the kids were soon unemployed. While all this was going on a start-up called Intel was being launched in California to make even-more powerful devices, called integrated circuits, and one of their founders had an article out in Electronics, a favorite magazine around our house, describing how such devices might one day represent hundreds or even thousands of circuits, with dozens of them fitting in that salesman’s paper bag. The article was illustrated by a drawing of a department store salesman selling something called a “personal computer.”

This is how the world of my great-uncle died. Transistors and computers made all his tools obsolete, soon after his retirement. Imperial Knife disappeared.

Around the time my dad sold Tower TV, in 1973, and headed for California, his world was dying too. The process of change that began there has only accelerated since then, with job-after-job, industry-after-industry, and profession-after-profession being absorbed into the new world of Moore’s Law.

The point is, I have living memories of all this.

Donald Trump is a decade older than I am. So are most of the people around him, and the people running the Democratic Party, and many of the people you see on the TV and in leadership positions throughout American Life. Compared to the world we live in, we’re old, obsolete.

The point of the current crisis is that economics, and politics, has not yet figured out how to adapt to the creative destruction of Moore’s Law. Certainly, Donald Trump hasn’t. He is about to be creatively destroyed by it.