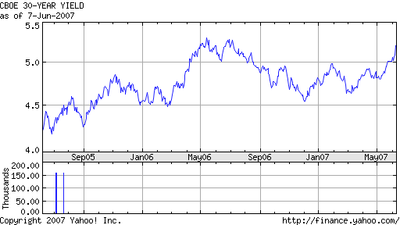

The strength of the American economy this decade has been remarkable. (Two-year chart of 30 year bond yields from Yahoo.)

Despite policies which seem feudal in intent, economic growth has continued, housing prices have remained stable, and the stock market has gone to new highs.

Why? China.

It has been China’s continuing willingness to recycle our trade deficit into U.S. bonds, at low interest rates, that has kept the whole world afloat. (They are also recycling our rising oil prices, at some minor cost for inflation.) Chinese leaders care about stability above everything else (wouldn’t you given the history of the last century) and have thus accepted an inherently de-stabilizing system in the hope of righting what they consider a grave injustice.

y

That injustice was the colonial grip the West held on China through

most of the 19th century, and which (Chinese feel) the U.S. held in the

first half of this century. All those U.S. 30-year bonds represent

leverage. They prevent all American politicians, no matter their true

feelings, from so much as questioning Chinese policy. Despite all the

talk of wanting a lower Yuan, Chinese leaders know this could cut the

value of those bonds, eat into hard-won principal. So they keep the

machine going.

But the machine can’t keep going. The structure is inherently

unstable. American demands for both guns and butter are pushing debt

demand beyond even what the Chinese can bear. Thus interest rates have

edged upwards. That reduces the stability of the system, in part by

dropping the value of older bonds.

There’s another American force driving us to recession, of course.

The housing crisis. House prices fall quite, quite slowly until you

reach a sudden capitulation, at which point they crash. That

capitulation has not yet happened, but market players can see it

approaching, as foreclosures rise, as buyers are pressed by tougher

lending requirements and rising prices for money. (Have you noticed how

the DiTech "People are Smart" rate has climbed 50 basis points since

the commercials first started airing a few weeks ago?)

I don’t have to tell you what rise gas prices do to family budgets.

Already I find restaurants emptying out. Already stores like Wal-Mart

are reporting "soft" sales. With deaths in Iraq, floods and droughts,

plus no Happy Meals, it sure feels like a recession even if CNBC denies

it.

But there is another reason for instability. Pollution. The greatest

source of instability in China today is pollution. Have you tried to

breathe in Beijing or Shanghai lately? Don’t. Tried to swim in a

Chinese river, or by the sea? Don’t. Checked the quality of the soil

lately? Don’t.

China has a crying need to spend on technology to deal with its

pollution problem, and with the general problem of hydrocarbons. While

our War Against Oil section

has demonstrated some interesting advances, few have yet reached the

market. We don’t have what they need. Without goods to soak up Chinese

demands for spending, we have big trouble.

Thus, bond yields are finally rising. If China allows the Yuan to rise in value, the equity value of its U.S. bonds will drop still further.

The losses from this will be enormous. The end.

Even a hint of this approaching reality is going to be enough to

spook the stock market, which has a hair trigger. That’s the last

source of rising wealth in the country.

One more thing. The policy assumptions of both political parties in this country are based on continued stability. Has Hillary Clinton addressed the question of getting us out of recession yet? John Edwards? Fred Thompson? Beuller?