The Bush Administration, perhaps being true to its nature, has decided to bail out the crooks who caused the sub-prime mortgage mess.

Democrats haven’t figured this out, and they may never do so, but here’s how the scam-scam works:

- The Federal Reserve says there is a "liquidity crisis."

- The Fed "injects liquidity" into the system by buying $35 billion in notes, for cash.

- These are mortgage-backed securities, the kind of garbage which is going belly-up all over the world.

- The sub-prime crooks get government cash, and Uncle Sam (that’s you) winds up holding the bag.

Economist Nouriel Roubini notes correctly that what is happening is not a "liquidity" crunch but a "credit" crunch. A liquidity crunch happens when you will have the money to pay back the bank, but you don’t have it all right now and need help converting assets. A credit crunch happens when you don’t have the assets to pay back the bank at all.

And if your credit crunch is big enough you own the bank.

This is what has happened in the so-called "sub-prime" mortgage market,

and I would add, in the so-called "prime" market as well. Lots of

homeowners, many with good credit, have rolled over their old loans

into fancy-schmancy no-interest and 100% equity instruments, pushed by

ads calling this "the biggest no-brainer in the history of Earth."

Now those loans are going belly-up, because the teaser rates are

re-adjusting. Your cost of money goes up, your monthly "nut" goes up,

you were never saving anything to begin with, the house is going down

in value anyway, you don’t really own equity, your equity may now be negative — why not let them foreclose and do it all again when

the market window re-opens? (That’s what sub-prime is really all about

— giving loans to people who’ve proven to be bad debts.)

This crap paper was packaged into securities and re-sold around the

world as "government-backed mortgage bonds" when it was, in fact,

nothing of the kind. Now lenders are getting picky over who they lend

money to (they want people who’ll pay the money back), so there are fewer buyers

just as the supply of foreclosed property zooms.

If this were a real liquidity crisis, the Federal Reserve could have

either dropped interest rates directly or made a "coupon pass,"

essentially giving banks cash in exchange for IOUs.

The Fed did neither of these things. Instead it cashed out mortgage

securities directly, without looking at the quality of the underlying

credits. And if you think those underlying credits were worth the paper

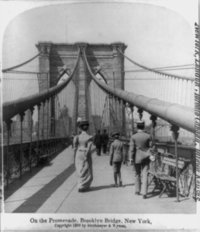

they were printed on, I’ve got a bridge to sell you. Now that is the

biggest no-brainer in the history of Earth.

Is there a chance in Hell that any Democrat is going to figure this out and call a crime a crime? Don’t bet on it, because Republicans would immediately accuse that Democrat of starting a financial panic and a new Depression. Besides all this started when the Clinton Administration let Fannie Mae and Freddie Mac turn ordinary mortgages into government-backed securities in the 1990s, and we don’t want to get the Big Dog angry.

Sorry, sucker.

Nexium overdose symptoms.

Prilosec vs nexium. Dangers of nexium. Nexium.