Think of this as Volume 11, Number 11 of A-Clue.com, the online newsletter I’ve written since 1997. Enjoy.

That’s an easy mistake to make.

In fact, it’s in the nature of our economic system that you go right up to the line of legality in order to maximize profit. Anyone who doesn’t do that is an economic loser, either in the short run or the long run.

You want to go right up to the line, peer down over the edge, and maybe move your toes back a bit. That’s what your lawyers are there for, to move your toes back a bit.

This is fine so long as the law is reasonable. If the law is reasonable and cops are on the beat, walking right up to the line of legality and staring down into the canyon is both legitimate and good business. It’s what makes markets efficient.

The problem in this case is the law was made unreasonable, and the cops chose to look the other way.

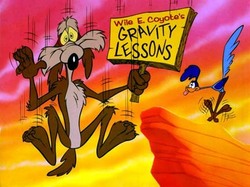

All the problems Bear Stearns caused were through the creation of new, "unregulated" markets. An unregulated market is a market that’s looking for scandal. Because there is no reasonable line you can walk right up to, it’s easy as heck to become Wile E. Coyote in such a market — everything is fine so long as you don’t look down.

The defaults on sub-prime mortgages last year were when we started to look down.

The same with the problem of having no cops. If there are no cops in

your neighborhood things may go OK for a while, but pretty soon

something happens, then something else, and it escalates until there is

no law at all, save the law of the jungle.

That’s what happened here. There was no law and no cops, so Bear

Stearns figured it could get away with anything. And in fact it did get

away with everything. Fact is it is still getting away with everything.

The leaders of Bear Stearns aren’t going to jail, because you can’t

show them a specific law they broke and there aren’t any cops around to

arrest them anyway.

What we did with housing in this decade is precisely what was done with

stocks during the 1920s. With no rules, and no cops, people ran riot,

as you would expect them to. One of the brightest moves Franklin D.

Roosevelt made was to create the Securities and Exchange Commission and

put one of the old market’s biggest scammers, Joe P. Kennedy (yeah,

that Joe Kennedy, right) in charge of it. Since he knew all the scams he knew

what to make illegal.

It was regulation that made the U.S. market the center of capitalism.

Regulations which guaranteed transparency and honest dealing. As soon

as these "unregulated" markets reared their ugly heads, several years

ago, it would have been wisdom for the world’s bankers and securities

regulators to get together and make such practices illegal, so as to

protect their markets. And to get some cops on that beat to make sure

things went according to the new law.

They didn’t. Ours didn’t. Neither did anyone else’s. Everyone was

afraid of losing the market to someone else with looser rules, or with

no rules. So no one had any rules.

And they all fell down.

That’s not clueless businessmen. It’s clueless government, and clueless

citizens, who bought a clueless political philosophy from ideologues as

rigid in their way as any turned out by Stalin’s Russia or Hitler’s Germany.

If some drug dealer came up to you, years ago, and suggested we make

the police force small enough to drown in a bathtub, you’d know why he

was calling for that and reject him out of hand. But people like Larry Kudlow (left) and Grover Norquist

were not only able to say these things, regarding financial markets,

but implement policies guaranteed to create the result we’re now

seeing.

If we learn nothing from this mess, it’s that calling for an end to

policing is calling for a market run by criminals. Banish these people

from any hand in policy. Banish everyone like them. Don’t let such

people on TV. They’re criminal enablers, criminal apologists. Seeking Larry Kudlow’s advice on

financial markets is like seeking the Medellin cartel’s advice on drug

policy.

To call such people statesmen is what’s clueless.

“If some drug dealer came up to you, years ago, and suggested we make the police force small enough to drown in a bathtub, you’d know why he was calling for that and reject him out of hand.”

Of course you could one up the drug dealer by simply legalizing drugs. Which points out the real problem with financial “deregulation.” By and large, the laws didn’t change and the system certainly didn’t become less complex (Sarbanes-Oxley for example). The problem was that no one was enforcing the laws. This essentially makes certain practices legal — but only for the dishonest.

Having rules that are disproportionately enforced is worse than having no rules at all. What we need are rules mandating transparency, preventing fraud and most importantly we need to end the moral hazard of bailouts. (Like letting Bear Stearns fall instead of having the Fed finance a buyout by Morgan. As soon as we end the notion of “too big to fail” then we’ll no longer have corporations that are “too big to care.”)

“If some drug dealer came up to you, years ago, and suggested we make the police force small enough to drown in a bathtub, you’d know why he was calling for that and reject him out of hand.”

Of course you could one up the drug dealer by simply legalizing drugs. Which points out the real problem with financial “deregulation.” By and large, the laws didn’t change and the system certainly didn’t become less complex (Sarbanes-Oxley for example). The problem was that no one was enforcing the laws. This essentially makes certain practices legal — but only for the dishonest.

Having rules that are disproportionately enforced is worse than having no rules at all. What we need are rules mandating transparency, preventing fraud and most importantly we need to end the moral hazard of bailouts. (Like letting Bear Stearns fall instead of having the Fed finance a buyout by Morgan. As soon as we end the notion of “too big to fail” then we’ll no longer have corporations that are “too big to care.”)