Back before my daughter was born I planned a great history of money. I spent one summer up in New York City researching it.

But I was never able to get past one simple statement.

Money is trust.

Money is the belief that what you are given will be returned to you in equal measure. Everything else — gold, commodities, oil — are intermediaries.

The reason you regulate financial markets is to assure trust will not be broken. Markets must run up to the ragged edge of regulation to be efficient. Rules must be in place to keep people from passing off junk as money.

The Republican Party has spent the last 40 years telling Americans that regulation is always bad, that government is always bad, that the public sector is nothing but a drain on the private sector. That is a lie. And it amazes me to listen, today, as Lehman has gone bankrupt and AIG circles the drain, knuckleheads including John McCain repeat this nonsense as though it came down from Mt. Sinai.

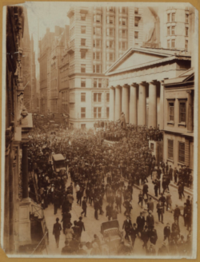

American financial history is marked by booms and busts, and until the New Deal these busts were total. In 1837, in 1857, in 1873, in 1893 and in 1907 panic ensued when trust broke down. The Federal Reserve was created in the wake of the 1907 meltdown, but it was unable to stop the leveraging of stocks on margin which created the 1929 Crash. And thus we had the SEC, deposit insurance, all the rest of it.

All this was destroyed, systematically, in the last two decades, an

effort led by Republicans and especially Phil Gramm (left). Gramm, and his

ideological allies, said that the market could regulate itself. They

said the market was globalizing and becoming so sophisticated that no

regulatory regime could control it anyway.

So the controls came off and trust was broken. It was broken first

through the mortgage boom, which started through the simple process of

turning bunches of mortgages into securities and selling those

securities as bonds with an implied (but not stated, even denied)

government guarantee. These securities were then sliced-and-diced into

new instruments which leveraged the gains and were then "insured" by people who didn’t know

what they were looking at.

At any point in this process the U.S. government could have said no.

It could have reined in Fannie and Freddie, knowing that their aim of

making home ownership affordable was being perverted, prices rising so

high that only funky terms could make a deal work for any buyer. It

could have regulated the CBOs away, but it chose not to.

Was it ideology? Was it a desire to fund the Iraq War without

actually funding it? It doesn’t matter. Trust was broken.

The U.S.

government let people create phony money, and phony money on top of

that phony money. Alan Greenspan did nothing to stop it. Bill Clinton

did nothing to stop it. George W. Bush did nothing to stop it.

So how to restore trust? There are three things to do:

- Add liquidity. We’re doing that.

- Let some firms fail. We’re doing that.

- Regulate all markets. We are not doing that.

To regulate a global market we need global treaties. But that process

starts with the U.S. proving its own markets and money trustworthy

again. It means restoring the regulations that prevented panics for 60

years, and punishing both the private and public crooks who created

these conditions.

John McCain is one of these public crooks. He was paid off in the Keating Five scandal,

the only Republican directly implicated, and the only one still in the

Senate. His chief economic adviser, Phil Gramm, is the man who most

directly created these conditions.

More important is the ideology these

men represent. It must be discredited, by you. It must be defeated, by

you. You are the only person who can start the market healing. On November 4 you must tell this ideology to Shut The Fuck Up,

and reject anyone who brings up this nonsense forevermore.

But there were other, private players. That is a job for prosecutors.

American prosecutors and European prosecutors. Do not listen to those

who claim no laws were broken here. We’re talking about common frauds

done on an uncommon scale. The CEOs who got golden parachutes based on

this nonsense must be sued and forced to return all that money. Many of

them should be shunted off to jail. Conservatives love to talk about

"sending a message" to drug dealers or pornographers. A message must be

sent. Those who break their fiduciary duty must be punished.

Once this work is well underway, then the United States can begin

negotiating new treaties with other major financial powers to assure

that this can’t happen, to make sure that all global markets are

properly regulated and transparent. Any country that refuses to sign or

abide by these treaties would then be shunned by honest businesspeople.