The Big Shitpile was created by greedy bankers leveraging themselves up to 40 times — 1 dollar in capital lifting 40 dollars in bonds.

That was wrong. It should not have been allowed. When leverage gets that high it’s impossible to get out of the position when the market turns around. Markets always turn around.

I saw this in the very first big story I ever did, a 1978 examination of a GNMA pyramid by a man then working for the University of Houston. UH had a huge construction boom going on, and the money was sitting around. This clown built a pyramid of bonds with it — buy a bond, get a loan on the bond, buy another bond. This worked fine so long as interest rates were going down (raising the value of the bonds, and delivering great gains on the pyramid), but when they shot up he couldn’t get out, and millions of dollars disappeared.

This was the same sort of deal, writ large.

We can’t have the government guaranteeing such nonsense. Any

institution which accepts the government’s protection (that of its laws or capital) must limit its

activities to what they can get out of. And they must reveal exactly

what they are doing, so the government is protected. That limits your

possible gains in rising markets, but it limits your losses in falling

ones.

Anyone who wants to run a pirate bank should be allowed to do so. But

not here. If you want to get around regulators go to some other

country, and seek their protection when you (inevitably) screw up.

In other words, this entire scandal was preventable. In deregulating

the financial system we made what happened inevitable, because markets

will always go right up to the edge of the rules (and some will slosh

over). When there are no rules, there’s nothing to stop the market from

going into the dumper.

So here’s the solution:

- All financial instruments, agencies, organizations and markets based in the U.S. must be regulated to maintain fiduciary responsibility, avoid over-leveraging and keep markets stable.

- All financial entities in the U.S. must have open, transparent

books, which the government can look at whenever it chooses to, on

behalf of the people.

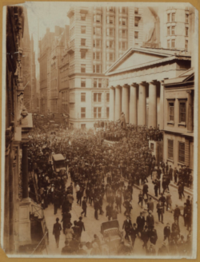

The Republicans have spent the last two decades destroying the edifice

of regulation created by the New Deal, and what we’re getting out of it is a second Great Depression. That edifice needs to be rebuilt, and

maintained by our children and grandchildren.

Let these days be the lesson. And, Larry Kudlow? Shut The Fuck Up! You have committed treason against the people of these United States for the last time.

Even though we screwed up and missed the 20th anniversary already, we really need a theatrical re-release of Wall Street. It seems like some lessons just need to be learned over and over as they run contrary to human nature. One such lesson is that greed is not good. Sadly, it seems the only way to really learn that lesson is to get burnt badly enough.

Even though we screwed up and missed the 20th anniversary already, we really need a theatrical re-release of Wall Street. It seems like some lessons just need to be learned over and over as they run contrary to human nature. One such lesson is that greed is not good. Sadly, it seems the only way to really learn that lesson is to get burnt badly enough.