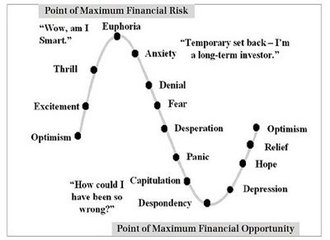

The most important task in any downturn is to reach the moment of capitulation.

(This neat graph of the emotional roller-coaster comes from, believe it or not, FinanceManila. Note how despondency at this point would be even better.)

The stock market has tried to do this several times in the last few weeks, and so far it has failed.

The real estate market, on the other hand, may finally be doing it. The number of homes sold rose in July. Critics called the buyers "vulture investors" taking on foreclosed properties, but they are all putting capital at risk, so God love ’em.

Markets can’t hit bottom until buyers come out and sellers start to disappear. In a fierce downturn this can happen anywhere from 30-50% from the market’s peak. In the case of the NASDAQ, you will recall, the market average fell from about 5,000 to under 2,000 before recovering. (The latest downdraft has it at 1,750, testing those old lows.)

Why should housing be any different? It shouldn’t. Prices rose in a bubble to unaffordable levels. Homes were unaffordable even to those willing to take out liar loans and balloon notes. Now they must fall until they are affordable by ordinary people, paying just 25-33% of their monthly net income, on fixed rate notes held by the lenders. Until we reach that point we may have hit a "bottom" but we haven’t hit firm ground on which to build a recovery.

As to everything else.

Despite the passage of the work-out bill the toxic assets remain on

the books. Toxic assets don’t just sit there, unsaleable. They really

are poisoned. The value underlying them keeps declining as they are

held, because by their nature they represent mortgages which can’t be

unwound under the terms of the investor’s contract, time is passing, so

foreclosure rates are rising.

We can’t hit a bottom until these toxic assets are bought up. What a

wise Treasury Secretary would be doing now would be going around to

Central Bankers and private parties, seeking even-more capital to add

to the $700 billion. They would also be holding their first auctions

now, buying up some of this crap and setting about the task of

recycling them. Now is when you’re going to see the highest profits

anyway — lock them in.

Unfortunately what central banks are now doing is tossing cash from helicopters. Buy up the bad assets so people can trade and you’re doing something worthwhile. Offering cheap loans on crap collateral won’t do any good.

So long as people are being advised to rush for the exits, they will

rush for the exits. The stock market needs some "vulture investors"

to step in, clean up the carrion, and get rid of the death stench.

Meanwhile, Google now has a trailing P/E of 22 1/2, and Berkshire Hathaway’s is 16 1/4. Wal-Mart’s is about the same. Take out Microsoft’s cash horde and the business is selling at a P/E near 10.

Bargains. They are getting better every day. The vultures and buzzards are licking their lips, but they will not step in until the other predators leave.

thanks for mentioning your source, sir. but i find it questionable as to why it would be difficult to “believe” if such a commendable article/graph could come from us people from Manila. Not all of us are ignorant hillbillies

thanks for mentioning your source, sir. but i find it questionable as to why it would be difficult to “believe” if such a commendable article/graph could come from us people from Manila. Not all of us are ignorant hillbillies