Think of this as Volume 11, Number 49 of A-Clue.com, the online newsletter I’ve written since 1997. Enjoy.

Perhaps the biggest policy failure of my generation is the demise of 30-year property.

Back when I was in college (30 years ago now coincidentally) we talked a lot about 30-year property. It was, as you might guess, property which could hold its value over 30 years and thus could justify a 30-year depreciation schedule. Roads. Airports. Ports. Homes. Skyscrapers. Things that were permanent.

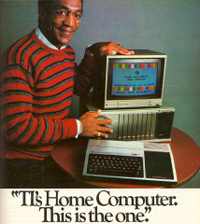

Partly due to the computer revolution this concept nearly disappeared from the business lexicon over the last 30 years. It disappeared from corporate America, which decided that research needed a shorter "pay-off," and that all other property needed shorter depreciation. And it left the lexicon of government as well, so roads deteriorated and suburbs grew in density willy-nilly with no regard for how people would use them.

Why blame computing? Computing really defines my generation, as manufacturing defined that of my parents. And what we’ve learned about computers is that they’re valuable for far less than their useful life. (Note the contrast with, say, cars.) A five-year old PC is technically sound, but it’s entirely obsolete. The same can be true of goods designed by computers, including the gear used to make computer chips. When you accelerate the pace of change this is just a byproduct, and its impact gets into the heads of policymakers at all levels.

A house should be 30-year property, but no one really thinks of housing that way anymore. Most folks are in-and-out of a house within three years, paying a 15% "tax" (two sales commissions plus moving costs) on each transaction. We have come to look at homes solely in terms of their price appreciation, not their depreciation costs, and this helped accelerate the crash we have just seen.

Point is, it’s time to take another hard look at 30-year property. I think this is the concept that should drive what history will know as the Obama Economic Plan.

A whole bunch of special pleaders are descending on Washington right now, drawn by the scent of free money and driven by the lack of any hope at home. And this is how their claims should be evaluated, in my opinion.

Call it Dana’s 30-year test.

If the government puts money into your project what will we have in 30 years?

(Cool train, huh? Too bad it’s in Shanghai.)

A lot of the answers here won’t pass the smell test. But some will. Space investments are 30-year property — we’re still flying shuttles designed in the 1970s. Basic research is good 30-year property. Roads are 30-year property, and so are railroads. (Railroads are also far more energy-efficient than roads in transporting both goods and people.) Ports are 30-year property. So is the re-construction of our electrical infrastructure, the "Enter-Net" that can both buy and sell power, saving the excess as hydrogen.

When cities and states come to Washington with their hands out they’re not offering to put it into 30-year property, so most of their pleadings should be rejected. The only way Detroit should get a dime is if they can convince us they have a future with a 30-year time horizon, given the investment we are being asked to make.

On everything else, the idea should be to save money, to reduce costs. In health care, in education, in the War Against Oil, the investments with the best bang for the buck are those which reduce costs in the short run. That’s where government needs to be re-engineered, and where the low-hanging fruit is for private industry.

This 30-year concept may be hard for baby boomers to get their arms around. For one thing we’ve never thought in this way before. For another 30 years from now most of us will be dead. But as our own horizons narrow our imaginations must expand. The time has come for us to think of those who will come after us and to do for them as Frederick Law Olmsted said he did for us. "Look, we built this for you."

In the last century we had only two decades that could really be called high points for the creation of 30-year property. The 1930s gave us many of our public buildings, our electrical grid, and our greatest centers of commerce — New York, Chicago, LA. The 1960s gave us the Interstate Highway System, which has defined how we have built our cities ever since, and the Space Program, whose technical breakthroughs still power our industry.

These were public projects because, for the most part, only the government has the power to see ahead 30 years. Companies like Control Data (or even General Motors) that tried to look 30 years out failed, as their sunk costs could never pay off and their carrying costs could not be recouped. Only government can look ahead that far.

We have spent a generation being told that "government is the problem" and that "government is them." Government is neither always-positive nor is it always-negative. It’s the people who run the government, and those who maintain them in office, who choose which it will be. Most important, government is not them — it’s us. It always was us, and when we were told it was "them" it was because a specific group wanted control of the government, for their own ideological purposes. (What Lincoln Steffens wrote over a century ago remains true — eternal vigilance is the price of belonging to a civil society.)

It is when we think in terms of 30-year property that we need to look first to government, because there men and women of vision can have that time horizon. That’s another of the 20th century’s great lessons.

So when you think in terms of 30-year property you do two things. You direct funds most effectively to the crisis. And you learn a powerful lesson, one you need to teach your children and grandchildren. In a democracy, government is us, and it is our duty, as citizens, to keep a close watch on it at all times, not being distracted by ideology, by cynicism, or (as in this decade) by an ideology of cynicism.

That way lies the madness we’ve just gone through.