In all the talk over bank bailouts an

obvious and very American solution is being ignored.

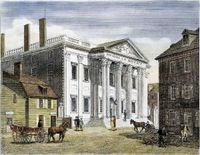

The original Bank was proposed in 1791

by Alexander (10-spot) Hamilton.

It fulfilled many roles the Federal Reserve now fills. A second

bank, chartered in 1816, was closed by Andrew Jackson to much

political rejoicing

– and the country promptly fell into a deep Depression.

The purpose of the Third Bank of the

United States would be to re-start the banking system. We could

capitalize it with the current TARP funds and then start making

loans. All kinds of loans, the kinds of credit facilities good

businesses need to keep operating, to make payroll, buy inventory,

all that. And the bank would charge a market rate – maybe just .01%

less to bring business in the door.

To make clear that this bank stands mid-way between government control and Wall Street greed, I suggest we put it where the first two banks were — Philadelphia.

Once the new bank was operating you

could let the existing banks fail. Instead of buying their worst

assets you could buy their best, and add these to the bank,

increasing its value. Later, as normal business began returning, you

could spin out these assets at a substantial profit.

As with the other U.S. Banks, the new

bank would exist for a limited period of time, 20 years, to allow for

an orderly and profitable liquidation. It would not hold tax receipts

– the Federal Reserve would continue to manage the system as a

whole – and the new bank would be regulated by the Fed as well.

As a U.S. Government entity the new

bank could be exceedingly transparent, so citizens could learn how

banking works. It could keep a lid on salaries and still get the best

people, because the best bankers are actually unemployed right now.

(It's the sharpies, shysters, and crooks who are still running the

private businesses.)

As existing big banks go bust the new

bank could take on their assets – the loans – at whatever price

the bank chooses to pay for them. Insured deposits would remain in

the private banking system, so there would be no takeover of that

system by the government.

Politically you could not call the new

bank “socialist.” The U.S. Bank closed before the term was even

coined. The U.S. Bank would do a much better job protecting the TARP

money than any bail-out could – it would practically be a

guaranteed money-spinner.

Now tell me why I'm crazy.

The Third Bank of the United States should not be a member of the Federal Reserve. The Fed is politically independent, the people aren’t considered responsible stewards of the economy. Rather, the bank charter should be so narrow in scope of activity that excutive opportunity for corruption is not likely. Start with home loans of median size/cost.

The Third Bank of the United States should not be a member of the Federal Reserve. The Fed is politically independent, the people aren’t considered responsible stewards of the economy. Rather, the bank charter should be so narrow in scope of activity that excutive opportunity for corruption is not likely. Start with home loans of median size/cost.