Back in the 1980s, when I was terribly intrigued over the history of money, I made an in-depth study of Samuel Insull.

Insull's main contribution to history was as a scapegoat for the Great Depression. He was tried for a variety of charges during the 1930s after his own holding company, which controlled most Midwest utilities in the 1920s, collapsed.

He was found not guilty, and in fact his actions had not been criminal. After arguing back-and-forth concerning the justice of his case, I have come to the conclusion that does not matter.

What does matter is that his case was cathartic. Insull gave those suffering from the Great Depression someone on whom to vent their frustrations whose actions were related to the cause of that frustration. They gave generations an object lesson to avoid.

What Insull did was use leverage to build his empire. Leverage, the manipulation of vast sums through the application of small amounts of capital, caused the Great Depression. Leverage is also the cause of our present distress.

Unfortunately, the scapegoats we have created so far had nothing to do with leverage. Bernie Madoff and Allen Stanford ran nothing but garden variety ponzi schemes, only with more zeroes than others. At worst, you can say they profited from a lack of regulation, a shortage of cops on the beat, which categorized the whole decade now ended.

What we need are better scapegoats.

We need scapegoats who teach the real lesson of our time, that leverage can be overdone, and that it must be restrained in order for the financial system to grow in an orderly way.

I think most people understand this, and that this feeling is behind the growing disquiet and unease concerning the Obama Administration. The feeling is growing that the Administration, especially Treasury Secretary Tim Geithner, is too close to Wall Street, and that we're throwing money down the same rathole, to the same people, who failed us in the first place.

What's missing from the story Joe Nocera wrote about AIG, over the weekend, is a villain.

Fortunately I have one. Joseph Cassano (left).

Cassano, who is my age, is one of the executives "credited" with creating AIG Financial Services, the unit that created the credit default swaps at the heart of everything. Cassano not only helped create the Confederate Money at the heart of the present disaster, he defended it as late as December, 2007.

As with Insull two generations ago I'm not certain Cassano broke any law. But, like Insull, he still makes a great scapegoat. Because of the lesson he teaches.

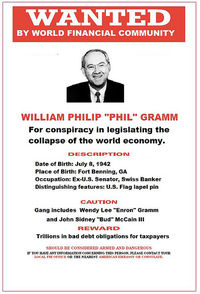

Everything Cassano did was enabled by changes in the law, engineered primarily by former Texas Sen. Phil Gramm. Unfortunately changing the law to make what should be illegal into something legal is not a crime, either. Just as using the loophole in the law thus created to create Confederate Money is not a crime.

Still, we need the lesson. We need someone to suffer. We need someone to, in a symbolic way, tar and feather. What Gramm helped create, what Cassano created, was the greatest financial crime in a century, a once-in-a-lifetime financial disaster for which everyone in the world will suffer from for a long time to come.

They need to suffer for it. They need to be made an example of.

I can't guarantee a conviction. As I say, I can't even say what law they broke. But having the people who truly caused the present mess in the dock would teach important lessons and deliver the financial system the catharsis it needs to recover and avoid over-leveraging for another 80 years.

If we don't do this, if we don't personalize what has happened, we may not learn that lesson, and we will leave our children vulnerable to repeating the mistakes of the present generation.

sky

Dana Blankenhorn: Scapegoats

phentermine hcl

Dana Blankenhorn: Scapegoats