Either way, you're talking big business. (Shown here is a BIPV installation on a Hong Kong building from PremierPower.)

The latest research from Lux Research on the market indicates we have three more years of working with architects and small builders before a mass market effort can be launched.

Lead author Aditya Ranade is still convinced that means a hockey-stick of growth, a straight line pointing upward. He estimates that by 2016 you'll have a $6 billion market with a capacity of 1 gigawatt of power.

An earlier study from NanoMarkets was even more optimistic, calling this a $11 billion market in 2016 .

There's a kind of irony here, in that the faster the insulation market grows the less demand there may be for actually producing power within buildings. (Shown here is a Boston solar shingle installation, from The Boston Solar Company.)

In the U.S. the acronym to know is LEED (Leadership in Energy and Environmental Design). Here it's commercial builders who are taking the lead, seeing low energy usage and some energy production as something that will bring higher rents. How much money the space costs to maintain electrically, per unit of time, is the metric to watch.

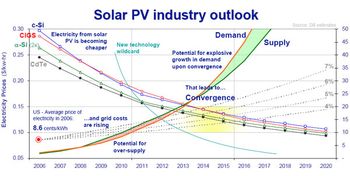

The big challenge for BIPV materials is the actual cost of the electricity materials generate, against the actual cost of the material. Insulation and energy production both serve to improve the Levelized Cost of Electricity (LCOE) for a building, and it's this balance which architects can measure.

Ranade says this provides opportunity for a variety of materials, especially multicrystalline silicon, Cadmium Iridium Gallium Arsenide (CIGS) and Cadmium-Telluride (CdTe). The first material leads in roofs, the last in facades, and the second is the obvious choice in siding.

One thing the report doesn't make clear is the importance of standards. The easier you can make installation, the cheaper you can make that installation system, the less labor you require to install a BIPV system, the lower its total cost and the closer it gets to grid parity, which is now the obvious industry goal.

The text of the report even gets into the question of standards, which admittedly need work. "A plethora of standards and building codes establish onerous performance requirements for BIPV,” it says on page 8, then includes a table of different tests and standard requirements. (It is actually good to see this, because it means progress can be accelerated with common sense lessons from the computing era.)

Once grid parity is achieved the market for any material skyrockets. Feed-in tariffs and other aids are a short-term solution aimed at helping finance the work needed to reach that goal. The need for such aid currently is a serious industry weak point, with oil and coal advocates ignoring their own huge subsidies in order to go after the pittances being lost in this effort. But breaking that bond to politics is as vital, in its own way, as breaking the economy's reliance on fossil fuels.

But this also means the big bucks are moving upstream, from the companies that know how to install or finance solar power installations, who can profit from subsidized rates on their electricity, to those who specify and order BIPV systems for buildings. Companies like Ecotemis, which are training such people, are in a market sweet spot.

The difference between the market estimates of Lux and NanoMarkets comes down to assumptions of how quickly costs can be scaled down through standards, and how quickly people can be trained to specify these solutions. And, remember, we're talking in both cases of global revenues, which can easily be impacted by government policies, or industry breakthroughs.

What I wonder is who are the plumbers that do the installations to such buildings?

What I wonder is who are the plumbers that do the installations to such buildings?

Dana,

Excellent article…. As always you hit the nail on the head with BIPV. I love to read your BIPV market write-ups…

Dana,

Excellent article…. As always you hit the nail on the head with BIPV. I love to read your BIPV market write-ups…

Dear Dana,

Apparently you are unaware that solar shingles shown on the picture you attribute (falsely!) to The Boston Solar Company are ILLEGAL. Those shingles (SHR-17) have been illegal to install on customer roofs in the United States since 2007 because they lost their UL certification. The manufacturer, Unisolar, is going bankrupt by mid 2012. By the way, the Boston Solar Company simply stole the picture without proper attribution – here is the original: http://www.flickr.com/photos/eastpole/2224762452/ – depicting a roof at the Kortright Centre in Ontario, Canada. If you look carefully, you will already see the delamination from three years ago (meaning, those shingles are now underperforming, if they are not entirely dead yet).

Now about BIPV: These latest reports come from the same clueless analysts who have been predicting that BIPV will take off for years (it is always three years in the future!). The simple fact is that BIPV is (roughly) 2x as expensive as regular PV (due to tiny , inefficient modules, mounting hardware, and extra labor) and generates (roughly) 1/2 of the power of regular PV (due to suboptimal tilt and overheating). That simple fact explains why BIPV is doomed. The “preferential” subsidies for BIPV in France and Italy, which have kept the scam afloat for awhile, are coming to an end, and BIPV will continue to become smaller and smaller niche. Just look at the public data from California Solar Initiative – BIPV’s share is something like 0.1% of the residential and commercial non-ground-mounted PV markets, and declining.

Dear Dana,

Apparently you are unaware that solar shingles shown on the picture you attribute (falsely!) to The Boston Solar Company are ILLEGAL. Those shingles (SHR-17) have been illegal to install on customer roofs in the United States since 2007 because they lost their UL certification. The manufacturer, Unisolar, is going bankrupt by mid 2012. By the way, the Boston Solar Company simply stole the picture without proper attribution – here is the original: http://www.flickr.com/photos/eastpole/2224762452/ – depicting a roof at the Kortright Centre in Ontario, Canada. If you look carefully, you will already see the delamination from three years ago (meaning, those shingles are now underperforming, if they are not entirely dead yet).

Now about BIPV: These latest reports come from the same clueless analysts who have been predicting that BIPV will take off for years (it is always three years in the future!). The simple fact is that BIPV is (roughly) 2x as expensive as regular PV (due to tiny , inefficient modules, mounting hardware, and extra labor) and generates (roughly) 1/2 of the power of regular PV (due to suboptimal tilt and overheating). That simple fact explains why BIPV is doomed. The “preferential” subsidies for BIPV in France and Italy, which have kept the scam afloat for awhile, are coming to an end, and BIPV will continue to become smaller and smaller niche. Just look at the public data from California Solar Initiative – BIPV’s share is something like 0.1% of the residential and commercial non-ground-mounted PV markets, and declining.

Troll,

What you mean to say is:

“c-Si BIPV is doomed along side c-Si traditional panels that require racks and penetrations mostly imported from China.”

I think the author really contemplates the design flexibility of thin film and the myriad form factor possibilities that can be created for building product integration.

unfortunatly for you the author sees through B.S.!

Troll,

What you mean to say is:

“c-Si BIPV is doomed along side c-Si traditional panels that require racks and penetrations mostly imported from China.”

I think the author really contemplates the design flexibility of thin film and the myriad form factor possibilities that can be created for building product integration.

unfortunatly for you the author sees through B.S.!

Here is some proof the author knows what he is talking about:

http://www.youtube.com/watch?v=9jr8v5jil7w

Here is some proof the author knows what he is talking about:

http://www.youtube.com/watch?v=9jr8v5jil7w