Think of this as Volume 16, Number 10 of A-Clue.com, the online newsletter I've written since 1997. Enjoy.

With natural gas prices having tanked, and the President being given stick on the campaign trail over high gas prices and failed subsidies at Solyndra and elsewhere, it may be hard to see that the War Against Oil is being won.

With natural gas prices having tanked, and the President being given stick on the campaign trail over high gas prices and failed subsidies at Solyndra and elsewhere, it may be hard to see that the War Against Oil is being won.

But it is.

The War Against Oil is a long-term project, begun some years ago, meant to wean the market from its dependence on fossil fuels and create a new era of sustainable abundance. It is at the heart of today's politics, oil interests having taken command of our politics 12 years ago and retaining an absolute stranglehold on the Republican Party. But this is, in the end, an economic struggle, and what ultimately matters is cost.

Solyndra, and the other loan guarantee recipients who have struggled, are in fact symbols of this war being won. They failed because their low-cost technologies could not compete in the marketplace, against lower-cost technologies. Because of the pressure created by companies like Solyndra, solar panel production costs are now below $1/watt, and they continue to decline.

The ultimate goal is a cost of roughly 50 cents/watt, which would make solar energy the cheap energy for much of the electric grid. It's already the obvious choice where the grid doesn't exist (which is most of the world), and it can be delivered where it is produced, a huge cost advantage.

Right now the market is dominated by a single technology, polysilicon, and by a single country, China. But the opportunity is so huge that American innovators, working with organic compounds, mirrors, and rare earths, are poised to blow through the current cost floor over the next four years and achieve real grid parity. And it's that point that is key here, because once you're competing effectively on price with fossil fuels, all you need do is scale profitable production to knock those fuels out of the market.

Wind is problematic. Over the long run, I don't think it competes with solar, because its costs fall only arithmetically, not geometrically as tech costs do. But wind is highly reliable. What's most important about it is that it has gotten buy-in from utility companies who have found markets for the resulting power, with “green credits” that draw companies like Google, Kohl's and Starbucks into paying subsidies so government doesn't have to, and which gives them an appetite for green power.

All of which brings us to cars.

These are temporary problems. All of them. Hybrid vehicle sales in February were up 55% over the same month last year, against a 16% rise for the total car market. Yes, America's car companies still trail Japan's Toyota, but we have not yet begun to fight. (And almost 21,000 Priuses were sold last month. Here's one.)

More important, there are alternatives.

Conservatives are now attacking a set of $14 million of research grants on biofuels, calling it “cloud cuckoo land” and going all punny in unison.

Why are they complaining so loudly about $14 million that was authorized in 2009? Methinks they doth protest too much.

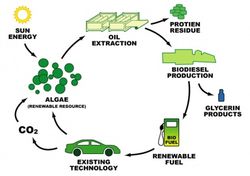

The Algal Biomass Organization (ABO) includes such companies as Boeing, Honeywell, Federal Express, Siemens and Waste Management. As noted before Exxon has algae energy investments. Chevron has already helped take an algae fuel start-up called Solazyme public.

OriginOil, admittedly biased as an algae oil start-up, says they can deliver oil or gas from algae at $2.28/gallon. For oil, that's close to the current market price. For gas, it's positively Gingrichian. A recent ABO survey found half its members believing they can get costs down to $3/gallon by 2020. Even the Department of Energy thinks we can get 17% of our fuel from algae.

CleanTechnica complains that, in touting algae and other alternative fuels, the President is not making an argument against global warming. Frankly, he doesn't have to. That argument makes itself, and it's a political argument we don't have to have. The only way this moves forward is with an economic argument, and with investments to match.

And that's what this is all about, a better future for my kids and yours, a sustainable future based not on digging up what the dinosaurs left us, but on harvesting the abundance that's all around us.

The Sun does shine, the wind does blow, the tides do roll, and (yes) we live on a molten rock.

We are only pushing oil consumption upstream to power plants. Farmers do benefit greatly from wind turbines, they are all over our region (Herkimer, NY).

Do the math on purchase of a Chevy Volt amortizing the expense over a 5 year period. You’ll find buying a $25K car with 28 mpg costs about as much.

So, until the production cost comes down, buying hybrids doesn’t really save money, green or not.

Dietrich

We are only pushing oil consumption upstream to power plants. Farmers do benefit greatly from wind turbines, they are all over our region (Herkimer, NY).

Do the math on purchase of a Chevy Volt amortizing the expense over a 5 year period. You’ll find buying a $25K car with 28 mpg costs about as much.

So, until the production cost comes down, buying hybrids doesn’t really save money, green or not.

Dietrich