But what if they're wrong?

Hard as it may be to believe, sometimes business is wrong about what is good for business. Business wants what it wants, but you're going to find sometimes you just might find you get what you need.

That was certainly true during the 1930s. The first Roosevelt Administration saw China-like growth numbers, despite the Liberty League calling FDR a “traitor to his class.” The stock market has long outperformed under Democratic Presidents, compared with Republicans.

Personally, I think the reason goes back to FDR's time, and his argument with Austrian economics.

The problem with the Austrians lies in their long history. Something changed in the 20th century.

Mass production happened.

Turns out deflation is much worse for an economy than inflation. Prices fall below cost and production rots in the field. Workers' pay falls faster than prices do, and workers lose their jobs. By 1933 the solution was obvious.

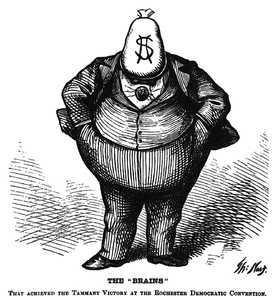

The problem with the solution, inflation, is that it takes money supply out of the hands of Wall Street and makes bankers earn that money all over again to maintain their share of the pie. It never seems to get through the bean-counters' heads that, as they work to get their supply of the whole back to where it was, that there is more-and-more money around, more-and-more production, more-and-more of everything. Higher wages, higher prices for raw materials and finished goods, a bigger market. Prosperity for all, not just the privileged few.

The deflation of the 1930s lay in raw materials, especially farm commodities. The stagflation of the 1970s saw deflation in the value of manufactured goods, as Moore's Law took hold. The deflation of our own time is in labor – there seems to be too much of it.

The answer today, as it was then, is the same. Inflation. More money. If inflation becomes a problem, as it did when France seized German assets in the 1920s, and when the Arab world seized western assets in the 1970s, then you deal with the root of the problem. Money isn't it. Workers aren't it. Retirees ain't it.

Now, yes, there are bad loans. There are always bad loans. You write off bad loans. You change your lending practices so you don't write bad loans any more. You take your losses. But whinging about bad loans, squeezing people who don't have money, won't do you any good. Austerity always fails. It's failing today.

The German and American bankers and politicians who are whinging about Hollande and demanding austerity have been proven wrong time-and-again for the last century. Why does anyone in their right mind think they'll be right this time?