Think of this as Volume 16, Number 25 of A-Clue.com, the online newsletter I've written since 1997. Enjoy.

Maria Bartiromo and Michele Cabruso-Cabrera have been doing this regularly. Lying.

They claim there is a debt crisis.

There isn't.

Oh, yes, current debt levels are unsustainable. But that's not a “crisis” for the debtor. It's really a crisis for the creditor, who must write down or write off the debts and take the consequences.

Oh, yes, current debt levels are unsustainable. But that's not a “crisis” for the debtor. It's really a crisis for the creditor, who must write down or write off the debts and take the consequences.

The consequence of the write-off is that the creditors may go under, as the debtors already are under. When people are giving away their children because they can no longer care for them, as they're now doing in Greece, I don't think the debtors can be squeezed any more. Time to write it off and walk away.

This was the solution the U.S. used in 2008 to defuse our own debt bubble. The banks survived only because the government, under Hank Paulson, put the new money into their hands. He didn't have to. Another government would not have done so. But at the point of the crisis, there was no way to wait for another government to take power and, maybe, put the money somewhere else.

The problem in Europe is one of national boundaries. The creditor countries, notably Germany, don't want to write off bad debts. They will suffer from writing down bad debt. So they continue to squeeze the debtor countries, continue to squeeze Spain and Italy and Greece, in hopes of getting a trickle of their money back and not having to write off the bad debt, which would hurt their banks.

Writing down the bad loans, of course, brings up the problem of writing new loans. The debtor countries continue to want new debt. This is the real heart of the problem, the new debt. That's what has to be negotiated. Banks are demanding high prices for the new debt, rightly fearing it's as bad as the old debt. But if there's less old debt you can write new debt on terms more favorable to the creditor.

The ultimate solution is to “nationalize” the debt by creating European-wide debt instruments, just as there is a European-wide currency. Germans, being the creditors in this case, refuse to sign on to such “Euro bonds.” But if they want their own economy to continue, they'll have to, and German voters understand this, even if the government does not.

The crisis will end when creditors acknowledge reality. Bad loans should not have been written. They need to be written off.

Why were the bad loans written? It was not, as American conservatives insist, the fault of the government. It wasn't because of the “Community Reinvestment Bank” that “forced” mortgage brokers to make liar loans.

It was the creditors, the banks, and lies they told themselves.

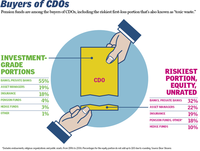

Who created the CDOs? Big banks. American banks, for starters. German and British banks, later. They were fraudulent instruments, worthless, and no one wants to admit that. Because admitting that would cause a lot of big banks to go under.

I have come to believe that Andrew Mellon's Depression-era advice to “liquidate” has been horribly misinterpreted in our time. He wasn't just talking about liquidating labor, and liquidating farmers. He wasn't just talking about squeezing the lower classes dry. He was talking about liquidating banks, of writing off bad loans, of walking away from bad debts, of taking the hit, even if that hit meant the end of the bank.

Debts get liquidated and the amount of money in the system goes down. Deposit insurance is paid and the amount of money in circulation goes back up. Note where the money is at the end of this transaction. It's not in the hands of a creditor, a bank. It's in the hands of people, who create new demand with it and get the economy rolling again.

Gold doesn't enter into it. If you want to hold gold and pretend that's money, go ahead. That gold has a value in the market, paid in money. But if gold is money then the money supply is controlled by creditors, creditors who may make bad bets and may never let the game re-start. Money supplies must be in the hands of government, with assets (and hyper-inflation) as the check against this power. When government creates too much money, assets leave the country, and the people take the hit as the money becomes worthless.

There are checks and balances on the system. Just not where the creditors say they are.

Maria Bartiromo is married to a big banker, whose father was a vulture capitalist. Her stance is based on self-interest. That of Cabruso-Cabrera, and the other business reporters who claim we have a “debt crisis,” is simply political. They work for the creditors, they align themselves with the creditors, and they have come to take the creditors' view as always true, the debtors' view as always false.

This doesn't mean they're right. It means they're biased.

There is no debt crisis.

What happens when no one will loan us money any more?

What happens when no one will loan us money any more?

Related Site

Dana Blankenhorn: There is no Debt Crisis

football news headlines

Dana Blankenhorn: There is no Debt Crisis

dr oz raspberry ketone

Dana Blankenhorn: There is no Debt Crisis