Think of this as Volume 17, Number 14 of A-Clue.com, the online newsletter I've written since 1997. Enjoy.

I know that liberal economists like

I know that liberal economists like

Paul Krugman want to dismiss David Stockman's latest book, The Great

Deformation as the work of a “cranky old man”

But it's not. It's the finest form of

political jiu jitsu. And it's dangerous stuff, very dangerous.

Stockman, who was briefly a Reagan

budget director, and who was then made wealthy by Wall Street, reveals here that his heart is in the Austrian

economics brought to this country by followers of Ludwig von Mises.

The Austrians thought they could deduce

The Austrians thought they could deduce

how economies run, and create policy from those deductions that would

always be right. It is a reductio ad absurdum,

a reduction to absurdity.

It cares nothing for data, and like all such exercises yields an ideology. This ideology destroyed Europe's economy in the

1920s, and the Austrians were chased out of Europe by Hitler, then

welcomed to America under the aegis of big money Republicans to act

as a counterweight to FDR.

The origins of a politics which equates

FDR's New Deal with Hitler is Austrian economics. The policy of

Republicans aimed at overthrowing the New Deal and all social welfare

legislation is Austrian economics. Another Austrian political thinker

is Amity Schlaes, whose model of proper economic stewardship turns

out to be Calvin Coolidge.

What's wrong with Austrian economics is

simple. They don't understand the nature of money.

Money is a medium

for exchange, whose supply should reflect demand for it. Austrians

think of it as a medium of value, whose supply should be restricted.

have the benefit of keeping money out of the hands of the mass of

people, and comfortably in the private banks of the very wealthy. As

a medium of value, it's too important to be left to the huddled

masses. It's like nitroglycerin, dangerous stuff, and must be

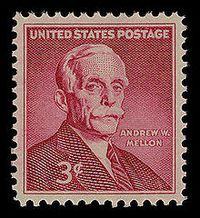

husbanded. That's what Coolidge was doing under his Secretary of the

Treasury, Andrew Mellon (right), and Mellon brought us the Great Depression.

The reason Schlaes wants to resurrect Coolidge is to ignore Mellon,

who stayed on under Coolidge's successor, Herbert Hoover (below).

As a medium of exchange, money is

fungible. When money is lost, when it disappears, it needs to be

replaced. When there is too much supply of stuff, money creates demand for it.

Hitler's command economy delivered unlimited demand for the

industrial supply of his time, in the form of the armaments of war,

and FDR ultimately was forced to do the same, ignoring deficits

through Lend Lease and other programs leading up to World War II. Austrian economics was thus shelved, until it would prove useful again.

of David Stockman and Amity Schlaes, is to re-set economic thinking

back to the 1920s, a sort of economic Eden in which things worked,

deficits were modest, and government was unnecessary.

When a flood

devastated Louisiana in 1927 Coolidge didn't spur the government to

act. Instead, as Randy Newman writes in his famous song he came down in a railroad train, “with a little fat man with a

notepad in his hand.” The fat man was Hoover, who would lead

private efforts to rebuild. All Coolidge could say was “isn't it a

shame, what the river has done to this poor cracker's land.”

In Newman's song, government is

uncaring, unfeeling, and impotent against the rising tide of nature.

It's Austrian economics in action.

What Stockman's book does, what

Schlaes' hagiography of Coolidge does, is give conservatives the

chance to renounce everything they have done since the Great

Depression. It lets them distance themselves not only from George W.

Bush, but from Ronald Reagan, and from a whole generation of

Republicans who said “yeah but” to Democrats' efforts against

economic want and need.

It's all based on a false idea, a false

ideology, but as Ed Rogers, who co-founded Haley Barbour's old

lobbying firm writes, Stockman is “useful.” Yes, he's extremely useful. John Meroney of the right-wing Claremont

Institute is also out with an article praising Stockman to the skies.

about the modern conservative movement. Its ideology is absolutely

rigid, and can never fail. It can only be failed by weak actors. I

had wondered for years why this seemed to be so, and I think I

finally figured it out.

It's because Austrian economics has the

same basis as Marxism. Austrian economics sounds like the opposite of

Marxism, but it proceeds from the same mistake, the idea that you can

take all economic actions, put them into a jar, and deduce what to do

from pure reason. The Austrians, like Marx, were 19th

century thinkers who had no conception of the scientific method, a

process of constant experimentation in which what works is shown to

us by our mistakes, in which mistakes are actually part of the

process.

Ideologies can't make mistakes. Marxism

couldn't make mistakes. Austrians can't make mistakes. Only men can

make mistakes. When they make mistakes, ideologues disown them for

failing the ideology. Thus they never learn from reality.

ideology, of any sort, when applied by anyone to the study of

economics or anything else. It is profoundly unscientific. It is, in

fact, anti-scientific. Which makes it all of a piece with climate

change denialism, with the denial of evolution, and with all the

other absurdities that make up the modern conservative movement.

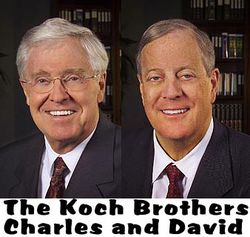

Just remember that the movement is not

what's important here. What's important here is who pulls the strings

on the movement. Money pulls the strings. And in 2013 that means oil money. Koch money.

The

most important thing liberals can do today is, like Toto, to pull the

curtain away from all this and show that the Great and Powerful Oz is

nothing but a show put on by fearful, greedy, oil men.