Think of this as Volume 17, Number 17 of A-Clue.com, the online newsletter I've written since 1997. Enjoy.

While most attention in renewable

While most attention in renewable

energy is focused on solar panels, or wind turbines, or the use of

pine pellets and algae for fuel, the real sweet spot is in storage.

Imre Gyuk , energy storage program manager at the Department of Energy, says

it's not just because solar and wind are intermittant. It's also

because an increasingly computer-driven society requires cleaner

power.

You know this in your own life. If you

have a desktop PC, chances are you have a Uninterruptible Power

Supply (UPS) sitting under your desk, or at least a “power

conditioning” power strip next to you – maybe both. Spikes can

damage critical components.

that realy cost are the short ones,” Gyuk noted. “It can bring a

production line to a grinding halt.” He said outages cost the U.S.

economy $79 billion annually, against a total cost of electricity of

$250 billion. The opportunity is being seized, and there's now a

large energy storage industry, which grew from 370 Mw under

management in 2011 to 686 Mw in March, 2013. But compare that to the

roughly 370 GW of power load required by the U.S. electrical grid –

that's ongoing load, not just potential production. There's a lot

more growth to come.

And that's why Bill Gates has put money

into Aquion,

a company developing batteries made of cotton, carbon and manganese

oxide, with salt water as its electrolyte instead of acid. It's why

he has also put money into Ambri and its liquid metal battery, as well as Light Sail Energy,

which is working on air storage.

economic success right now is Gyuk's work in bringing storage to bear

on our electric grid. DoE now has 111 storage projects going on,

against 30 in the rest of the world. Some of Gyuk's investments have

been failures, like Beacon Power, which went bankrupt despite

installing its flywheel technology near Albany, NY,

or A123, which is now owned by a Chinese outfit but has 32 Megawatts

of storage online in West Virginia.

Or Zinc Air,

a company the DoE isn't currently backing, which is working on

zinc-iron redox flow technology.

Gyuk estimates that for every 1 Mwatt

of grid energy, we need about 200 Kwatts of storage, storage that can

be turned on-and-off like flicking a light switch, in order to even

out power fluctuations. By contrast, what GE is offering, natural gas

back-up for renewable energy sources, is highly inefficient. It can

take a half-hour to bring even a natural gas turbine online, Gyuk

said, and the grid needs a much faster response.

A simple regulatory change can make a

huge difference in getting this storage online, increasing the prices

storage systems can charge for their services. One such change is

currently before Congress in the form of HR 1465, an Investment Tax

Credit for batteries. Another was FERC 890, a Department of Energy

pay-for-performance plan on grid storage that doubled profit for

storage companies at a stroke.

Lithium ion batteries have been getting

a lot of headlines lately. They're used in your iPhone, and in the

Boeing 787 Dreamliner. They're not perfect, but they can be recharged

again-and-again, which is a key to success in this field.

Energy can be stored-and-forewarded on

a grid-level, on a community level, or on an individual level. Gyuk

offered an example of how individual energy storage might work.

instead of just selling batteries in their electric cars, simply

lease them for five years. A lithium ion car battery loses just 20%

of its re-charging power in that time, Gyuk said, meaning its range

declines by that amount. If the battery is sold, the owner may keep

using it another year, or two, or three, accepting the lower range to

save a few bucks. But the battery that comes in after such overuse

has uncertain characteristics. If you lease the battery and take it

back after that time, it still has about 80% of its capacity, and can

be comfortably used in a grid energy storage system – on a large

scale, a community scale, or even on an individual scale. (It could

be tested, re-packaged, and re-sold for storing solar energy, for

instance, as its original value would have been fully depreciated.)

The battery opportunity is what makes

stories like this one,

from the University of Illinois, so important. By applying

nanostructure science to the cathodes and anodes in batteries, the

Illini have able to make lithium-ion “microbatteries” that can be

combined to store far more energy, and which charge 1,000 times more

quickly, than other designs. Without using different materials, in

other words, we can dramatically increase the storage density of grid

batteries, at low cost.

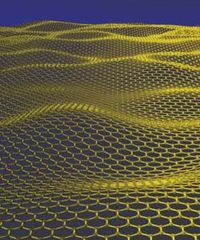

there may be graphene, which you can think of as a Buckyball that has been turned into a

sheet. It exhibits the same hexagonal structure you find on old

soccer balls, and can be produced with a simple DVD burner.

Graphene has its weaknesses – it can lose its structural integrity

at the edge of sheets, creating a “windshield crack” effect

across the sheet that may cut its effectiveness in half – but the material's opportunities are so vast that these kinks

are being ironed out quickly, on a global basis. One way to do that:

manage it alongside other materials like silicon.

“As energy storage becomes more

important companies will come out of the woodwork,” Gyuk concluded

in an Atlanta talk I covered recently. The DoE maintains a great site

about its energy storage experiments at energystorageexchange.org.

This is the sweet spot right now in

renewable energy, the point where the bleeding edge of technology

meets real business needs, and where profit opportunities are vast

for the most cost-effective solution. Storage today is where basic

solar was at the turn of the century, but it may develop twice as

fast.