Think of this as Volume 17, Number 38 of the newsletter I have written weekly since March, 1997. Enjoy.

Even Noubar Afeyan, the MIT professor

Even Noubar Afeyan, the MIT professor

and entrepreneur I interviewed this week, does not believe it's

possible.

The idea of an energy glut is so

fantastic, so far outside normal business experience, as to be

inconceivable, he told me. Especially given the millions now entering

the global middle class in India, in Africa, and in Latin America. Of

course they'll want TVs and cars and the other trappings of American

life. They will compete financially to get them. And that will keep

energy prices high for at least a decade.

But the U.S. is already in an energy

glut. Natural gas prices here remain stubbornly below $4/mcf. The

“spread” between U.S. oil prices and global prices narrowed to a

few dollars recently, but has since expanded again. And E85 ethanol

(which actually contains just 15% alcohol) is priced at nearly 50

cents/gallon below the price of regular gasoline.

The U.S. economic recovery, such as it

The U.S. economic recovery, such as it

is, has been driven by the creation of new energy. Shale oil, and

gas, has nearly made us energy independent, but the amount of solar

and wind energy in our grid has also increased dramatically, and the

cheapest form of renewable energy – efficiency – has kept demand

from growing. Costs across this energy front are going down,

continuously, and there is no reason to believe that this will

change.

Shale technology was pioneered by a man

I once interviewed, the late George Mitchell. He explained to me,

back in 1980, that conventional drilling only extracted half the oil

in a field. New technology could take out half of what remained. He

turned out to be right. There are enormous environmental challenges

in shale drilling, and the geology of overlying rock structures has

yet to be taken into account, but as a base technology it works.

Bakken, or Texas' Eagle Ford, can work just as well in Saudi Arabia.

In theory it can even work offshore, although I think the risks are

too great right now to go there. Especially since companies like

Norway's Statoil are still finding big pools of oil off the coasts of

Canada, and Brazil, and Angola. Especially since Iraq's oil is barely

being exploited, and Russia is now using new technology to more fully

exploit Siberia.

Critics note that shale drilling

carries enormous risks. But here's another hard fact. It's also very

expensive. Shale deposits are among the world's most expensive to

exploit, exceeded in base cost only by what Canada calls its “oil

sands,” which are really just bitumen that factories crush and mix

with natural gas liquids before dumping on hard-pressed refineries.

It's low quality, and carries a low price – margins are already

razor-thin.

Afeyan and I talked mainly about a

company he's backing, called Midori Renewables. Midori says it has a biocatalyst that can extract sugars from any

cellulosic fiber for pennies per pound. In theory, my son the

chemistry student explained, it's really pretty simple, since

cellulose and sugar consist of the same chemical compounds – break

the bonds of cellulose, as your own body breaks the bonds of starch,

and you get sugar, our primary biological fuel.

won't be interested in your biofuel start-up until you can get your

costs down well below $3/gallon. They want it to be as low as $2.40.

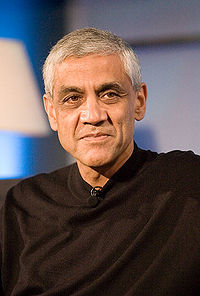

But KiOR, backed by Sun co-founder Vinod Khosla, has already gotten there,

and it's producing the equivalent of diesel oil from ordinary pine

pellets, in Columbus, Mississippi, at about that price.

Well, you think, if a company like KiOR

can make that work, others can too, so the cost of the needed biomass

would have to increase. They forget that the Columbus plant is just a

demonstration, that KiOR's biocatalysts – like Midori's – can

work on all forms of biomass.

Another way to increase the amount of

exploitable biomass is to plant something different. New types of

castor beans can grow during Brazil's dry season, without fertilizer,

during times when the soil is otherwise fallow, and their oil can

also be used as fuel. Evogene, an Israeli company, has demonstrated

just this.

What happens when you combine cheap

cellulosic alcohol, cheaper sugars, and new types of oil-producing

crops that don't damage the environment, with markets hungry for new

energy? You get even more downward pressure on oil and gas prices.

seeds of its own destruction. The last recovery was driven by cheap

money, meant to hide the costs of an illegitimate war, driving up

asset prices and causing banks to offer “liar loans” to millions,

around the world. The previous recovery, the Internet boom of the

1990s, was driven by unlimited supplies of new intelligence, which

eventually bumped against demand that could not keep up with it. The

recovery before that, in the 1980s, was birthed by low oil prices and

policies that made money more valuable, becoming vulnerable to the

higher prices of a new war and the ability of markets to destroy

money on a whim.

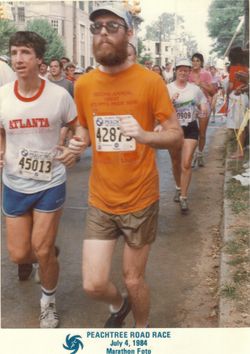

Our present path is most like that

“stagflation” decade of the 1970s, in which high oil prices

caused a boom in places like Houston, where I lived then, and a

long-lasting recession in places depending on trade and assets, such

as Atlanta, where I live now. Thirty years ago, when I was in the

market for a new house in Atlanta, the city was still recovering from

the impacts of that real estate collapse, and the previous decade's

white flight from the center city, so I was able to get into a lovely

home, next to a train station, for under $50,000, and the neighbors

thought I was being ripped-off.

1981, was also the peak of that decade's boom. Interest rates and oil

prices were heading down, and the Houston economy would take a decade

to recover from the blow.

In other words, energy booms carry

within them the seeds of their own collapse. I knew Houston was

heading for trouble in 1980, soon after talking with Mr. Mitchell,

when I listened to an economist describe how he'd created economic

models for that city based on rising, falling, and stable energy

prices, with each one showing a recession ahead. No one listened to

the warning I gave readers, any more than they listened to me 20

years later, when I warned about the coming dot-bomb.

There is currently an irrational

exuberance, across the oil patch, and throughout the energy sector,

based on a mistaken assumption that rising supplies will always get

their price, whatever it is. This defies economic logic. At some

point the fear of downward pressure becomes self-fulfilling.

Most of the oil market consists of

untapped reserves, and these reserves are the basis of the industry's

economics. They're assumed to be of increasing value, which is why

most remain untapped. Even the fear that this may change, that

reserves in the ground may be worth a little less next year than they

are this year, will be enough to set off a panic.

And that is going to happen. Not this

year, not next year, maybe not for another five years. Or, as Afeyan

thinks, 10 years. But it will happen, and I happen to think it will

be sooner rather than later, because markets are based on psychology,

and as we've seen throughout my life investor psychology can turn on

a dime.