Think of this as Volume 17, Number 47 of the newsletter I have written weekly since March, 1997. Enjoy.

The Internet is not a medium, in the way that newspapers, magazines, or even TV are media.

The Internet is not a medium, in the way that newspapers, magazines, or even TV are media.

The Internet is, and always has been, something else entirely. It is so vast, so complete, and so easy to use that the vast majority of us can't conceive of all its capability, let alone use it.

What schools should be teaching right now isn't so much writing, or math, or even science, but the proper use of the Internet, and how to get what you want from it. That's not just a question of teaching people to find stuff. It's a question of teaching people how to ask better questions, and frame what they get into something meaningful. The reason it's not taught is because no one knows exactly how to do that, even now, so educators are baffled as anyone else.

Thus Wall Street has always treated the Internet as just-another medium. And it has misled no company so much as Yahoo.

Yahoo could have been Google. Before there was Google, there was Yahoo. But Wall Street didn't understand the Internet then any more than it understands the Internet now. So it urged Yahoo, and the other search engines of that time, to become “portals,” to become “media companies,” and under a CEO laughably named Tim Koogle, Yahoo did just that. And in doing that, it lost the future.

Yahoo could have been Google. Before there was Google, there was Yahoo. But Wall Street didn't understand the Internet then any more than it understands the Internet now. So it urged Yahoo, and the other search engines of that time, to become “portals,” to become “media companies,” and under a CEO laughably named Tim Koogle, Yahoo did just that. And in doing that, it lost the future.

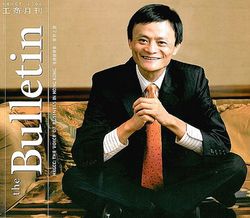

Today's Yahoo is essentially worthless, just as rivals from that past time like Altavista, Lycos and Excite are only names from history – they no longer exist. . Its value as a stock is based entirely on a decision co-founder Jerry Yang approved 8 years ago, to invest $1 billion into a company called Alibaba. Alibaba was founded in 1999 as a business-to-business company, but a Hong Kong Chinese named Jack Ma wanted to turn it into something more like Amazon, more like eBay.

Since then Alibaba has been doing a long dance with the Chinese government. They didn't want a Hong Kong Chinese running the company. Fine, Ma stopped being CEO. They didn't want a foreign controlling interest. Fine, Yahoo's out. Then Alibaba started playing hard ball, threatening to list in New York rather than in China. Now they're talking about listing in China again, perhaps with a U.S.-traded ADR on the side.

Meanwhile, the company keeps growing. It's now the chief small business bank serving a nation filled with small businesses. This in addition to its other assets. The company may be worth $100 billion, which means speculators could easily turn this into a $200 billion company. Yahoo's smaller stake in Alibaba is thus worth more than its larger stake had been.

This seems to have been a turning point. Rather than Yahoo taking over the Times, the Times' New York mentality has taken over Mayer. That mentality believes in the short tail, in “content” rather than data. After hiring a bunch of Timesmen to “improve” its own worthless news operation, Yahoo has now taken on former anchor Katie Couric.

You know what happens if Yahoo becomes a dominant media company? Very little. Because media is a very small niche within the larger Internet. Mayer's moves have failed to bring Yahoo any organic growth at all, and the latest media nonsense isn't going to change that. The only reason to own the stock is for the Alibaba stake, and as soon as we have a firm value for that it's time to sell.

What Mayer should have been doing was focusing not on media, but on increasing Yahoo's cloud capacity. I would be much more willing to buy Rackspace than anything they have bought, or failing that a company like InterNAP . Real talent today programs clouds, not TV stations.

Mayer should also be more interested in the mechanics of e-commerce, and on e-commerce infrastructure, than she has been. No company is better positioned to bring Alibaba's services to the U.S. market – to build a real bridge between small Chinese entrepreneurs and American consumers – than Yahoo. Position yourself to become that bridge.

My guess is that, despite all her bravado, Mayer is intimidated. She thinks she can't compete directly with her former employer, Google. But that's not true. There's far more left to do than even Google can do. If what you're doing on the Internet is worthwhile, it will find its way, you'll make money at it. That's not true for any TV show, for any play, or for any story like this one.

Circling back to my first point. What can a company like Yahoo do to help teach the youth of the world how to make better use of this medium? What can a company like Yahoo do to help people do better searches, ask better questions, and gain more sophistication in their research?

All the answers to nearly all the world's questions are here, on this medium, and at its end is a vast sea of other questions, the answers to which will extend the Internet's frontiers to infinity and beyond.

That's a lot more exciting than any TV show.

My guess is that, despite all her bravado

My guess is that, despite all her bravado