Think of this as Volume 18, Number 4 of the newsletter I have written weekly since March, 1997. Enjoy.

But that age has been dead for a half-century now.

In 1964, a chemist-turned engineer named Gordon Moore wrote an article for “Electronics” Magazine stating that the number of circuits etched onto a single slice of silicon might double every year or two, for as far in the future as he could see.

What became known as “Moore’s Law” has profound implications for economic theory. As computing has become central to everything, it has produced enormous deflation throughout the economy. Moore’s Law now touches every part of the computing landscape – from storage to radios to the transmission of data. Better and better gets faster and faster.

Assembling PCs closer to customers, with “just in time” parts inventory, gave Dell his edge, until the value of those parts, and those PCs, deteriorated further to eliminate that advantage.

The deflation of computing has only accelerated since Michael Dell’s heyday. Today there is no industry that is not impacted by the deflationary impact of ever-faster, ever-cheaper computing. Every industry has become more productive.

Even oilmen are more productive – they can find more oil with modern tools, direct their drills closer to the resource, design and build systems to explode shale and extract it. They can do this on a global scale. But they’re in a race to drive down costs against a host of renewable energy technologies, including the cheapest renewable technology of them all – efficiency.

All this represents deflation in action. The value you can extract from each dollar of investment goes up, you need fewer dollars to replace labor with machines, productivity rises and employment has to be redirected, toward things that computers can’t yet do. Like massage therapy or yoga instruction.

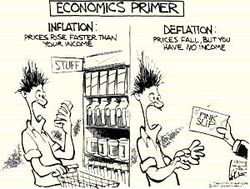

Deflation is much, much worse than inflation. We see this in every recession. Falling prices create unemployment, unemployed people can’t afford the lower prices, so prices go down in a vicious cycle. Pretty soon your dad is getting punched over a can of soup – don’t let your dad get punched over a can of soup.

But their theories fail to take into account the deflationary impact of Moore’s Law, impacts that are only increasing as devices like the iPad and WiFi radios bring the miracles of cloud computing within the reach of billions around the world.

The only way to prevent the deflation of Moore’s Law is to keep pumping new money into the economy. The speed of that pumping may change with the economic times, but the pumping must continue to keep up with the supply of goods and services Moore’s Law creates.

Yes, we can.

The greatest miracle of Moore’s Law is deflation in the value of all kinds of goods, and many kinds of services. The only industrial costs that seem to rise are those for chip foundries, which must rise exponentially as chips become more complex, in line with Moore’s Second Law. Raw material costs also rise in cost, but Moore’s Law lets people find alternatives, and keep those price rises to a minimum.

What differentiates economies is the value of their human capital. It’s the ability of people to do what computers and machines can’t do that now defines economic competitiveness. It’s the value of our labor, our best-trained minds, that is our best defense against deflation. It’s our ability to attract such minds, and investments in that human capital, that pay off best in the competition between nations.

Moore’s Law makes cheap labor cheaper, but it makes skilled labor ever-more valuable. Germany, which exiled the Austrian economists 80 years ago because their theories could not hold society together through the Great Depression, leaving Europe to be torn between the false choices of fascism and communism, has this right.

The productivity of every man and woman, their ability to do what cheap computers and cheap machines can’t do, is what creates national wealth in our time.

This is the economics of Moore’s Law.

as a yoga teacher, where perhaps one in one hundred yoga teachers can make

enough money to be considered lower middle class by that alone, and perhaps

one in one thousand can make a true upper class income career at it, your comment quite

amuses me. ironically my best hope in that business is to make

and sell ever cheaper videos through Amazon. . using

cheap computing video editors and cheap digital camcorders.

as a yoga teacher, where perhaps one in one hundred yoga teachers can make

enough money to be considered lower middle class by that alone, and perhaps

one in one thousand can make a true upper class income career at it, your comment quite

amuses me. ironically my best hope in that business is to make

and sell ever cheaper videos through Amazon. . using

cheap computing video editors and cheap digital camcorders.

Never thought I would equate Moore’s law to such a level it makes quite a lot of sense. There is lots of opportunities to invest in emerging markets like those in African markets. But its true that a country’s greatest strength lies in its human resource that can do what modern disruptive technology cannot do.

Never thought I would equate Moore’s law to such a level it makes quite a lot of sense. There is lots of opportunities to invest in emerging markets like those in African markets. But its true that a country’s greatest strength lies in its human resource that can do what modern disruptive technology cannot do.