Think of this as Volume 18, Number 17 of the newsletter I have written weekly since March, 1997. Enjoy.

I haven’t always felt like I could. There have been many years where money was tight. But I did it anyway. I put money away and forgot about it.

There are lots of ways you can do this, even if your salary is modest. Open an IRA and, even if you have a job, you can throw $2,000/year into investment, tax-free.

If you’re self-employed like me, you can throw 15% at your account, every year, tax free. Support your employer’s 401(k) all you can, unless it’s heavily invested in the employer’s stock. Or, if you’re in your 20s, life insurance through a good mutual company (one that is owned by policyholders) can work out well.

Once your money has gone into an investment account, try to ignore it. Pretend it does not exist. Don’t let your short-term problems interfere with your long-term interests. If you can’t afford a house right now, or the kid has problems, you find another way to get that money. You don’t own your investments. Your future does. If you eat your own seed corn you’re going to impoverish yourself over the long term.

But what should you invest in, especially if you don’t have much to invest?

As to which specific stocks to buy, don’t even play that game until you have enough in your mutual fund that your own stupidity won’t kill you. Then do your homework.

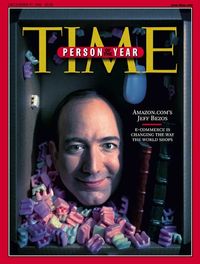

I look for the best-run companies around and buy them when they’re out of favor. Right now I’m buying Amazon.com. I’m losing money on it. But when everyone was hating on Apple, when it was down near $400, I was a buyer. I’m now ahead.

Traders are always looking for momentum. Investors shouldn’t do that. The reason is that investors have one big advantage that traders don’t have, and that’s time. Traders worry about the pennies that high frequency traders take on trades, or the dollars they take on sudden moves, because they are in competition for those pennies and dollars.

Big money runs in packs. It seeks leverage, it follows momentum. It may not even be in stocks right now. Because of leverage, big money can be playing in bonds, or energy, or other commodities, and the stock market will decline while this is happening. It runs like the tides. Buy when the tide is out.

So when tech stocks are in favor I’m looking at banks and retailers and manufacturers. When profits are in favor I look for growth, and when growth is in favor I look for profits. It’s not that hard.

You just have to do is consistently. The tax laws make this easy. Use them.

If I sound like a conservative despite my forays into political liberalism, that’s the way I like it. There’s no inconsistency between wanting to make money with your money and wanting a better world. That’s something thieves like to claim. Most people in business aren’t thieves.

Most people, in fact, are pretty awesome.