Think of this as Volume 18, Number 42 of the newsletter I have written weekly since March, 1997. Enjoy.

History doesn’t repeat itself but it rhymes.

Our decade reads like a bizarro version of the 1970s. We’re going through an oil shock, but it’s in reverse.

The 1970s were vulnerable to such a shock due to the nature of the economy. We were a manufacturing economy. Inputs of raw materials and wages determined prices and profits.

But beneath the headlines a new kind of economy was being born, one based on Moore’s Law.

In the 1990s Microsoft dealt with it through bloatware, piling new functions into Windows so people had to replace their PCs. In our time Apple is dealing with it through refreshes of its product line, each iPad thinner and each iPhone more powerful to maintain its price points.

We have become blind to this deflationary pressure, yet it exists and it accelerates. Cloud technology is highly deflationary. Amazon keeps cutting prices, and competitors have to respond. The assumption is workloads will expand to make up for it. But that’s always true. What’s actually happening is that companies are turning off old technology, killing old tech companies like IBM.

We barely notice deflation in the Internet, but it’s very real. Anyone can get video today, because the cost of moving bits keeps going down. Sites are adjusting by adding more video – often unnecessary video – and de-emphasizing cheap-to-ship word bits that communicate more efficiently. It’s the modern version of bloatware.

What we’re facing is a real deflationary spiral. And no one seems to care.

I did a search for stories about this and came up with this bit of nonsense, an Australian economist practicing the same faith-based idiocy that has kept the recovery from expanding for five years. He still thinks inflation is the real threat.

Folks like this usually point to Germany in the 1920s, when money became worthless and savings were destroyed. But those concerned about deflation have a better example to point to, that of Japan over the last 15 years. Or they can look to our own history.

Yet the cure was so simple. Inflation. Print money. Declare a dividend. Make loans. Create demand. Fear of inflation kept this cure from really being implemented during the 1930s – the increases of the national debt during that period were modest. It was only through World War II that the economic cure was administered, in the form of armaments, and the hangover has continued from that day to this. America today remains essentially what World War II made us – a military state.

There has to be another cure for deflation than that, and there is. Instead of helicopters dropping money on banks, or the military dropping bombs, give money to people. Create an infrastructure bank. Get done some of the things we promised ourselves we’d do years ago, but put off. Or just write off some bad debts, like the student debt created by for-profit colleges over the last decade. There are all sorts of things we can do, and every single one of them would be of direct benefit to ordinary people.

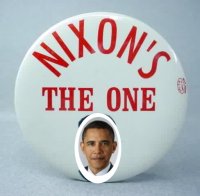

Yet the route to that seems politically closed. Republicans have decided that, the playing field of the current election being tilted so far in their favor, the white, Nixon-Wallace states holding the Senate’s balance of power, they should make this 1988 all over again. They’re running exclusively on fear, expecting the knees to jerk so they can achieve a little short-term power.

But for what? So they can squeeze out more debt repayments to banks that don’t need the money? So they can cut taxes on rich people who aren’t spending, and whose investments are falling in value because no one else is spending?

The same thing is happening now with President Obama. Rather than confronting Republicans directly, on what they’re doing to promote deflation, he is focused on the ground game, on registering new people to vote and stoking fear of Republicans in order to get them to the polls.

It won’t work. Well, it will work to a limited extent. But it won’t give the President the victory he seeks. You need both an inside and an outside game to win an election, both a ground game and an air war. He should have bombarded Kentucky with ads praising its Kynect marketplace, and making the link between that and “Obamacare” explicit. He should have been putting out a positive agenda, rather than playing defense on what he’d done, which is so easily twisted.

Of course, since history rhymes we know how this movie ends. The 1970s ended with a resurgent conservative movement and Ronald Reagan, who validated the Nixon Thesis and whose legacy still haunts us.

Who will be the liberal Reagan? Whoever it is, their legacy will be to whip deflation and spend the money needed to keep America from going the way of Japan. The economic history books will be rewritten by that, and people will ask why policymakers of our time, and analysts of our time, were so blind to the real threat.

The answer is, because they were looking backward.