The oilpatch, or the oil exploration industry, has always lived in a boom-and-bust cycle. When I was in my early 20s it boomed, and so did Houston. We were Dubai before Dubai was cool. Then prices busted in 1981 and the city followed.

The oilpatch had another boom early in this decade, with the rise of fracking. The idea is credited to George Mitchell, a man I interviewed while at the Houston Business Journal, and involves shooting water, sand and chemicals down a wellhead to break apart the rock, allowing oil and gas to seep out of the new cracks.

This boom-and-bust cycle happens in other industries. It happens all the time. One result is an incredible, awesome supply of cheap and useful stuff after the boom is over. It’s happening right now in memory chips, which will mean faster clouds, PCs without any moving parts, and intelligence added to everything in your house, your neighborhood, and your world over the next decade.

Speculators are always looking for the next boom, so that when the common herd of investors gets there it’s busted, and they go broke. That’s what social media was about – boom, bust, and see what’s beyond. That’s what Bitcoin was about. That’s what the current entertainment boom is all about. Even the clouds will, in time, burst.

The next boom is already out there. What’s interesting to me is it looks an awful lot like that 1970s oil boom.

It’s in drugs and medical devices.

Today’s stock market is filled with such stories. It’s also filled with dry holes, companies that thought they had something but didn’t. Theranos is one example. Here’s another. Dendreon. They had a treatment approved for late-stage prostate cancer. But it was expensive and extended life for just a matter of months, on average.

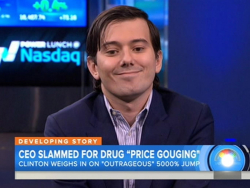

While most public attention is filled with the industry’s crooks, scam artists who pushed expensive drugs through the payment channel, then sent the profits overseas, or raised prices by 1,000% or more even while their costs remained constant, there is real excitement in real solutions to terrible problems.

I don’t know what’s going to happen with either of these companies. I’m more inclined toward ABIO than NVCR, but what do I know? I told a friend to dump Sarepta a month ago and it promptly rose $20 per share. (It’s down from there.)

There are two reasons this will end up like the fracking boom.

First, we can’t afford this stuff. Take Sarepta’s Duchenne treatment, called Exondys 51. It only treats 13% of the genetic mutations causing the disease, but it costs $300,000 per year. Sarepta got this into the payment pipeline despite a study with just 12 patients, because the families of victims demanded it.

Then there’s discovery itself.

We’re creating new treatments at an accelerating rate. Thanks to breakthroughs in DNA research, thanks to Moore’s Law, and thanks to new fields of research like immunotherapy, billions of dollars are being tossed into university research centers, so there are soon going to be multiple cures for many conditions.

This is how we circle back to my oilpatch analogy.

In a competitive market, as you’ll find in Europe and Asia, choices mean government can force competition. Government can choose to pay for this treatment instead of that one, based on cost, and companies that don’t get through can pound sand. Or they can cut their prices.

More important is this. When there are multiple options for a cure everything becomes a commodity. Competition forces prices down, which is why natural gas still costs less than $3 per mcf. I see this in my own life. The statins and ARBs I need to live are dirt cheap, as the patents have expired and there are several suppliers. But the value of patents will go down when there are multiple solutions to the same problem.

The biotech boom has a sell-by date. Doesn’t mean it’s not going to be fun while it lasts. If you’re near retirement and don’t have enough in your bank to do better than cat food, this at least gives you better odds than the riverboat casino.

Just know when to get out.

I love the topics you cover. Always an interesting read. Thank you!

I love the topics you cover. Always an interesting read. Thank you!