After the market falls, when everyone is in despair, is when I get the most excited about the future.

After the market falls, when everyone is in despair, is when I get the most excited about the future.

That’s because recessions aren’t so much an ending as a beginning.

A recession means the old games no longer work. The oldest business processes disappear entirely. WE have seen this during every recession of my working lifetime.

Small towns fell under the onslaught of Walmart in the 1980s. Big boxes replaced department stores in the 1990s. In the 2000s, whole layers of middle management disappeared. In this decade, gatekeepers like insurance agents have gotten the boot.

All this came about because of artificial intelligence. In its crudest form, computers took over work formerly done by people. In the 1980s, bar codes and computer networks replaced the people handling delivery channels and supply chains. In the 1990s this let stores specialize and deliver more product within specific segments than department stores could stock, at lower prices. In the last decade it meant bureaucrats disappeared, replaced by databases running applications like Customer Relationship Management (CRM) or Enterprise Resource Planning (ERP).

All this came about because of artificial intelligence. In its crudest form, computers took over work formerly done by people. In the 1980s, bar codes and computer networks replaced the people handling delivery channels and supply chains. In the 1990s this let stores specialize and deliver more product within specific segments than department stores could stock, at lower prices. In the last decade it meant bureaucrats disappeared, replaced by databases running applications like Customer Relationship Management (CRM) or Enterprise Resource Planning (ERP).

In this decade, apps replaced financial middlemen.

In business, and in technology, everything that works when it’s launched faces a sell-by date. Here is just one example.

For investors that spells opportunity. But what do you seize? Who knew that Amazon was the play 10 years ago, or that the Google IPO was a great deal in 2004?

What you’re looking for is productivity. Whoever can deliver the most added value, whoever can replace the most people with software, and scale it, is going to win. Efficiency is the cheapest form of renewable energy. Turning mental drudge work into an automated process is money in the bank.

A lot of people have been complaining, as this recovery rolled on, about artificial intelligence replacing people, and their whining has had an effect. Factory automation, transport automation, and delivery automation haven’t moved nearly as fast as they could have, not to mention renewable energy and medical automation.

Now they will. The companies that buy it, that learn how to use it, and implement it will come out the other side of this recession. Those that don’t, won’t.

The same has been true in the computer age that began in 1946 and reached lift-off with the PC revolution 40 years ago. Court reporters and bookkeepers complained when CP/M machines and Visicalc made them more productive, but those companies which adapted cut costs and prospered, while the complainers simply disappeared.

The final buzzwords for the new games aren’t in. Right now, we’re talking only about artificial intelligence, broadly. What works will combine cloud applications with intelligence at the network edge. This is the “World of Always On” I’ve been writing about since 2003. During this decade it has been called the “Internet of Things.”

We’ll see it next in supply chains, because you don’t have to worry about whether businesses that are open are able to receive the goods with minimal loss or breakage. All we need are specialist firms to build the applications for it. The same will be true with ambulances, as the size of crews is reduced, and as cars get smart enough to handle non-emergency pick-ups, with patients connecting themselves to apps measuring vital conditions, starting the diagnostic process while they’re on their way to a clinic.

Both step changes start as incremental processes, they’re operating systems and applications, they save money and deliver a return on investment quickly. That’s the low-hanging fruit of the self-driving car revolution, followed by things like getting you home from the bar. Over time, as the installed base grows and scales, the application set expands. Pretty soon you’re car-pooling in a van that created its pickup route online and came without a driver.

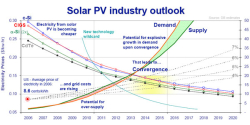

Now might be a good time to pick up some solar stocks, like Canadian Solar and First Solar. Shared solar power microgrids, mainly sharing the cost of battery back-up, are going to become a thing. Costs for solar and wind energy have now fallen below the cost of coal and natural gas.

In places without energy infrastructure in Africa, Asia, and Latin America the difference in cost is even more stark, more obvious. This is how you get a thumb down on oil prices, through the market. When it costs less to operate an energy-intensive business in South Africa than in South Carolina, the plant will move. So, too, will the money.

This is where you want to be investing now. Move money slowly out of index funds and put it into productivity. Look for winners, know that not all plays are going to work, and double-down on those which do.