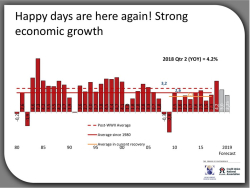

Inflation is minimal. Money is cheap. Unemployment is down. Wages are rising.

Here is why I think this is all going to collapse, and that right soon.

Deflation.

As I have said here many times, technology creates deflation. Deflation is the primary subject of my Moore’s Law book, which I’m getting ready to rewrite for 2020.

To understand deflation in action, look in your hand.

Back in the 1980s, when I was a young technology journalist, the late (great) Jerry Pournelle predicted that “by the year 2000 you’ll be able to find out anything, instantly.” He was right. Just Google it.

When the movie “Desk Set” ran on TCM recently, Katherine Hepburn’s research staff beat the EMMARAC computer (then science fiction) at getting IBM salesman Spencer Tracy detailed information on Corfu. When the first character said “Corfu” I looked it up, on the phone in my hand, and had the information before the movie did.

Clouds and devices have created enormous amounts deflation, ripping up whole industries, replacing them with something we use mainly for cat videos or to insult one another. Older systems, from wired telephone networks to the mainframe software that once processed credit card transactions, are now called “technology debt.” They’re worthless.

While Moore’s Law covers only the density of circuits on silicon, it has been shown to touch every other technology, and everything technology touches, with its deflationary power. That power extends around the world. The Internet in Maputo, Mozambique is 10 times faster than we had on my Atlanta street 25 years ago. Thus, growth in Africa’s economies now trumps our own. New infrastructure delivers today’s functionality without the technology debt of the West.

This deflation and technology debt are present everywhere. This is especially true in energy, the source of most of America’s economic advantage. Right now, increasingly-efficient fracking and oil-finding technology mean we pay less for energy than almost anyone else. But technology, and scaled production, are changing the equation. Even given the cost of batteries, they’re both now cheaper than coal. New energy infrastructure can thus be built that costs less than you’re paying, and without the “technology debt” of all our pipelines, refineries, and gas stations (never mind the pollution).

My son works in biochemistry, the world of amino acids and DNA. A few years ago, he found that a lab-mate had run blood through a mass spectrometer and found that leukemia patients with many broken kinases (the amino acids that do the cell’s dirty work) wouldn’t respond to chemotherapy, while patients with fewer broken kinases could be cured with chemo. My son automated the test, using the computer language R, which was developed for statistical work in clouds. He had learned R just a few months before. The heart of the work took him just a few weeks.

Now he’s working to automate more such tests. The result will be a library of such programs, a software stack making such automation easy for researchers a decade from now.

Anything that can be modeled by software can be processed by clouds and devices into a new, stunning reality. To those of my parents’ generation, this would be indistinguishable from magic.

But there’s a downside.

Deflation is the downside.

The deflation of the 1930s was beaten by inflation and (most important) war, which made inflation acceptable. The government printed money. Bread that had been due to go down from 10 cents to 8 cents a loaf was back at 10, maybe 12. Conservatives were suspicious of this, because it devalued the “gold” in bankers’ vaults. They created an entirely new school of economics to debunk this miracle, the Austrian School of Economics. Before we could use data to prove or disprove economic theories, the Austrian School seemed to make sense. It was as logical as Newtonian physics, before Einstein.

In the world of abundance created by Moore’s Law, the Austrian School is stupid. Yet that’s where our economics is coming from today. Because the Austrian School seems to protect the wealth of the past, because it makes money a noun instead of a verb, a thing rather than a medium of exchange, something whose value can be protected in a bank vault, Austrian economics is fashionable on Wall Street and in Washington, both run by people who already have money.

The Trump Administration has temporarily gotten slightly ahead of inflation by handing out $1 trillion to its friends, in the form of new debt, and through control of the oil market, that is the 80-year old alliance between the Saudis and Texas oil men.

But hoarding wealth won’t stop deflation. Bill Gates can’t recycle his wealth fast enough. Neither can Jeff Bezos, Mark Zuckerberg or the Google Guys. Their wealth is piling up in unimaginable heaps, $150 billion in Bezos’ case, all while billions of people are starved of investment.

It’s unsustainable. It’s asking for a crash that will force economists to fully reckon with Moore’s Law.

Interest rates of zero aren’t nearly cheap enough when the borrower lacks the money to pay back what was borrowed, because of deflation and technology debt.

Remember that the next time the market starts to wobble. It’s the most important sentence you’ll read this year.

And to even make matters worse the Democrats are letting in over 100,000 illegals “Every Month” at our southern border. These nice folks have no skills, no education, don’t speak english. They will NEED free housing, free food, free medical care, free schooling, in other words just something more that the Taxpayers of America can put on their backs with this burden. Just so the Democrats can get their POWER back. Its just a power grab just like reparations. Americans have been in a great transformation for a long time now. Many industries are being replaced. But americans who have a good education are resourceful and will figure it out.

And to even make matters worse the Democrats are letting in over 100,000 illegals “Every Month” at our southern border. These nice folks have no skills, no education, don’t speak english. They will NEED free housing, free food, free medical care, free schooling, in other words just something more that the Taxpayers of America can put on their backs with this burden. Just so the Democrats can get their POWER back. Its just a power grab just like reparations. Americans have been in a great transformation for a long time now. Many industries are being replaced. But americans who have a good education are resourceful and will figure it out.

test

test

No one will read this but I have three minutes to practice my typing. I have no idea where the author derives his data. Inflation is double-digits right now while unemployment is 35-42%. The gig economy ensures that a further 12-18% are underemployed. Roughly 64-85 million are a subsistence level and have no real impact on the economy. A few more residents will not result in any change in lifestyle for all but the few that provide them resources to exist. It is a non-issue either way it goes. Education could not be valued lower and merit is meaningless with widespread cronyism. Sounds dystopian because it has been for over 40 years when we entered that age when all manufacturing started overseas immediately after WW2 and completed in 1965. Words do not effect change amongst those in power so writing about it is moot, whether a blogger or a newspaper.

No one will read this but I have three minutes to practice my typing. I have no idea where the author derives his data. Inflation is double-digits right now while unemployment is 35-42%. The gig economy ensures that a further 12-18% are underemployed. Roughly 64-85 million are a subsistence level and have no real impact on the economy. A few more residents will not result in any change in lifestyle for all but the few that provide them resources to exist. It is a non-issue either way it goes. Education could not be valued lower and merit is meaningless with widespread cronyism. Sounds dystopian because it has been for over 40 years when we entered that age when all manufacturing started overseas immediately after WW2 and completed in 1965. Words do not effect change amongst those in power so writing about it is moot, whether a blogger or a newspaper.

Nice post author. Thank you for sharing.

Nice post author. Thank you for sharing.

Thank you for such a nice post. Keep it up.

Thank you for such a nice post. Keep it up.

Thank you for your post. Keep it up.

Thank you for your post. Keep it up.