A political tsunami is most likely when Wall Street gets out of step with the economy.

A political tsunami is most likely when Wall Street gets out of step with the economy.

While it’s not yet showing up in the statistics, the U.S. economy is already in recession.

If you import or export, your business is down. If you’re a retailer, your business may be gone. If you’re a farmer, only the government is holding you up. If you’re a manufacturer and you’re not named Boeing, you’re struggling. If you’re in transportation you’re hurting. If you’re in the oilpatch, you’re dying.

The reason this isn’t apparent can be seen in the latest headlines from Maersk, the Danish shipping company. Their sales are down, but so are their costs, so their profits are up, and so is their stock.

How can profits be rising, and thus stock values, if we’re in a recession?

Thank the Cloud Czars. The deflationary impact of technology continues to grow. Moore’s Law grinds on. Each time an application goes into the cloud, the costs of running it go down and its impact on the market rises. The Gold Rush continues.

Thank the Cloud Czars. The deflationary impact of technology continues to grow. Moore’s Law grinds on. Each time an application goes into the cloud, the costs of running it go down and its impact on the market rises. The Gold Rush continues.

But if the “Cloud Kings” are in trouble, as Jim Cramer insists they are, the market’s view may finally be catching up with economic reality.

You first need to distinguish Cramer’s Cloud Kings from my Cloud Czars. He’s talking about software companies such as Adobe, Workday, and Salesforce.com, companies whose database-based cloud applications are transforming how business gets done.

But the Czars, Microsoft, Apple, Google, Amazon and Facebook, the companies that own the clouds, haven’t been doing great either. Amazon is still more than 10% from its high. Google has yet to break through its high, either. The action is in Apple, which is a device company, on Microsoft, whose cloud continues to gain share, and on Facebook, now that people have realized only 5% of its business is in the U.S.

It’s these companies, and the whole Cloud Ecosystem, that has been holding up the stock market. Portfolio managers have been adjusting to a reality I pointed out at the start of the decade, that technology is the only thing working.

It was a disconnect between what was happening in tech and what was happening on Main Street that was blamed for the rise of Donald Trump. It’s this disconnect that will be responsible for his fall.

Let’s back up a moment to talk about politics.

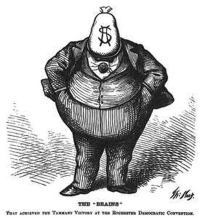

The Trump coalition in 2016 consisted of Militarists, Mullahs and Moolah.

The militarists are backing away because of Syria.

Then there’s the Moolahs. That’s Wall Street. I’ve watched with dismay as Cramer has gone full-on Trumpist or has seemed to. He’ll deny that to the sky, but the people he trusts to tell him the direction of the economy are all on Wall Street. Wall Street is all-in on Trump.

Since Trump’s inauguration the Dow Jones average, which is what Wall Street sells as the market, is up by 33%. The S&P 500, which represents the real market, is up nearly as much, 31%. The NASDAQ, which mostly represents tech, is up 44%. But the Gross Domestic Product, the economy’s actual output, is up just 11%. Leon Cooperman, a Trump loyalist and hedge fund manager, claims the market will fall 25% if Elizabeth Warren is elected. He’s right, but that’s only because the market is inflated.

The anger can be misdirected. Tech’s as hated today as oil was in 1979, even though that’s what is driving the economy. Tech’s being blamed for troubles it has no control over. It’s blamed for the disconnect between the human capital we’re supplying and what it needs. Tech’s support of “charter schools” means only 1 in 10 kids are getting a quality education. Unless you’ve got the money for private school, the odds are against you.

Aligning the real needs of technology, a blossoming of human talent and potential, with the policies of government, is going to take a decade. This was true in the case of oil, which needed the protection of the military-industrial complex to maximize oil’s power on the economy. This change is going to happen slowly, and tech is going to come to Washington on little cat feet, as it must.

What’s going to get it closer is the Recession of 2019, which has disconnected the Moolah Administration from the real economy.