The stock market is not the economy.

The stock market is not the economy.

The fall of Trump is secure because of that.

Trump has long confused the health of the stock market with the economy. But 84% of stock is held by people in the top 10% of income. The bottom 80% own just 6.7% of shares.

Whether it’s true or not that most Americans own some stock, as the nit-pickers at Politifact want you to believe, the fact is that prosperity is going to fewer-and-fewer people. (Thanks to two careers in tech, some of it is flowing to me.)

This trend has accelerated during the Trump time. Among the hottest stocks today are companies that cater to the needs of poor people. Dollar General is up from $60 to $160 since Trump’s election. A former Dollar General CEO, David Perdue, is a Senator from Georgia as a result. The other Georgia seat is held by Kerry Loeffler, whose husband runs Intercontinental Exchange, Atlanta-based owners of the New York Stock Exchange.

You may think Trump’s base consists of racists and mullahs, but it’s really moolah. A Goldman Sachs client survey shows 87% expect Trump to be re-elected. Hedge fund billionaires love this market, and they love Trump, even though they know his pumping of stock prices must end.

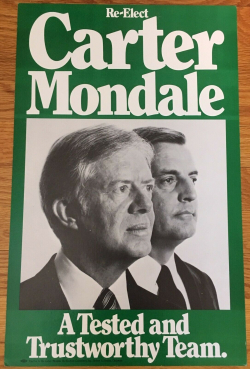

I’m one of very few reporters working today who was doing this job in 1980. I’m on the same business beat I was on then. I was also politically active in 1980.

But labor and farmers changed while Democrats weren’t looking. By 1980 just one-quarter of workers were in labor unions. It had been one-third a decade earlier. That percentage has continued to decline. It’s now barely one-tenth. Farmers have also moved solidly into the Republican camp. This is supposed to give that party a stranglehold on power. Sound familiar? It does to me.

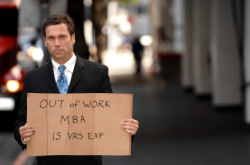

They’re being replaced by software. A small team that can link financial databases together and deliver something that cuts friction from finance can make a fortune today. The guys who sold Plaid to Visa recently are all in their early 30s.

Fintech destroys financial jobs every day. Fintech takes people out of the Trump base and puts them on the street. Add the job losses of fintech to the narrowing of the investment base, and you start to see why political assumptions needs a major readjustment.

Some of the people being made redundant by fintech have big retirement accounts. If you’re over 55, chances are you don’t mind much being let go, and your 401k means you see a rich future ahead. You’re still in the Trump base.

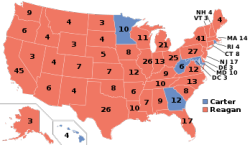

The key to understanding politics involves following the money. In 1980 the money had moved decisively away from manufacturing. In 1980 money came out of the ground, or in recycling it. Banks, brokers, insurers, and wholesalers would create the Reagan-era boom. That’s why Republicans dominated the era, not just here but around the world.

The same thing had happened a half-century before, only in reverse. Liberals dominated from the 1930s through the 1960s because the money was in manufacturing. What manufacturers needed was demand. Roosevelt created demand, as did his successors. Mass employment with economic stability gave Democrats the whip-hand in politics.

Money that once came out of the ground now rains down from the clouds.

The golden rule of politics is that he who has the gold makes the rules. Three of the five Cloud Czars – Apple, Microsoft and Google – are now worth more than $1 trillion each. Amazon is right behind them, and Facebook is worth $630 billion. Behind them are a huge retinue of hardware companies, software companies, and service businesses, holding much of the rest of the stock’s market value. Every other business, no matter what else they may claim to be doing, must dance to tech’s tune.

Trump’s policies only work for tech’s billionaires. Many of them, like Bill Gates, Marc Benioff, and Laurene Powell Jobs, see these policies as self-defeating. They know that the money tech makes must be recycled, it must be invested in creating tomorrow’s brains, or growth won’t continue. The nation’s tech centers, like San Francisco, Los Angeles, Seattle, New York, Boston, they’re all Democratic bastions. So are all the other cities where tech employment is rising, and where density is increasing.

Land doesn’t vote. Money votes. The money that’s rising has gone to the Democrats. The country will follow. Or the country will fail.

everything is about money

everything is about money