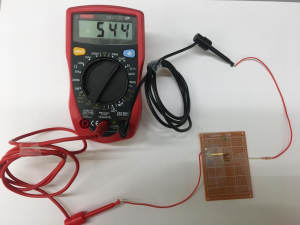

As the war drums beat post-war planning isn’t given a second thought. (To the right, the Air-Gen, which pulls energy directly from the air.)

As the war drums beat post-war planning isn’t given a second thought. (To the right, the Air-Gen, which pulls energy directly from the air.)

We can do better. We need to do better regarding the War Against Oil.

Make no mistake. The War Against Oil, which I first wrote about over a decade ago, is behind our current crises. Saudi efforts to destabilize the Middle East are funded by oil. Russian efforts to destabilize the U.S. are built on oil. Trump is all about oil.

But oil is losing. Oil is doomed. The coronavirus, COVID-19, proves it. The International Energy Agency now sees falling global demand for oil at the end of the year.

We should have seen this coming. While Democrats were arguing about “banning fracking,” the frackers were flaring off more natural gas than ever before. Even with that, they couldn’t get $2/mcf for it. The UAE recently said it found a giant pool of gas, close to its export terminals. Texas gas is losing what markets are left.

COVID-19 puts the lie to all of this. Futures markets show oil prices even lower in November than they are now.

At some point, very soon, the value of reserves must be readjusted. Chevron has already begun doing it. The pace is going to accelerate.

The knock-on effects will be enormous. Producers will be tempted to pump more now rather than see what they have become worthless. This accelerates the price decline. Russia is already doing it.

This is just the start of what’s going to happen. It’s not just countries we hate that are about to go through economic meltdown. Canada is already going through it. Mexico is on deck. Alaska, Texas, Oklahoma, North Dakota. Oil doesn’t have to become worthless for its economic absence to have an enormous impact, just worth less.

Wherever you find technology workers, you find Democrats. Even in red states like Alabama, tech centers are growing, making elections closer. That’s why some Democratic strategists are urging the party to look South for growth. Race has nothing to do with it. It’s about tech.

The War Against Oil will be won. But it will be messy. There will be real wars. There will be bloody revolutions. There are likely to be some heads on pikes. Innocent bystanders will be murdered. That’s the way sudden change works. Incremental change can be planned for, revolution can’t be.

How can we ameliorate this?

Second, plan for it. There are going to be economic depressions in the Arabian Peninsula, in Russia, and through the central U.S. There will also be higher oil prices, as investment halts and renewable growth fails to keep up. We can reduce that by investing in education and technology for tomorrow’s thinkers. Scholarships now, profits later.

Third, invest in it. If you want to be rich in five years, find some alternative energy start-ups. Invest across a broad front. Most will fail, some will succeed, and a few will succeed spectacularly. Ignore old renewable tech like First Solar and Sunpower. Look for the new stuff, which will be more efficient and less costly once it scales.

Finally, expect it. A lot is going to happen in the next two years. A lot of it won’t be pretty. There will be setbacks. Most pundits and reporters have no damned clue what’s coming.

You do.