Cash flow created the Cloud Czars. Cash flow is why Amazon is worth $1.6 trillion while AT&T is worth one-eighth as much.

Cash flow has always existed. But it was something to spread around. It was profit. When calculating whether a company could afford its dividend, analysts would do it in terms of cash flow.

That’s because business accounting isn’t just about cash. It’s about all the kinds of money that flow through the business. It’s about loans and equity, about costs that are capitalized and those that are written off on taxes.

Dividends paid for with cash flow are the lifeblood of conservative investing. Financial planners make their money moving retired folks’ money into bonds or companies that pay a regular dividend. A company that pays fat, regular dividends has its stock bought by retirement funds who don’t make trouble for management.

Tech companies don’t like to pay dividends. The thinking goes, if I’m giving money to shareholders it’s because I don’t have any other use for it. Until the last few decades very few tech companies paid dividends. They saw capital gains, the rise in the stock price that comes with growth and profit, as the shareholders’ reward.

The way companies like IBM and AT&T finance capital spending is with loans. They issue bonds with a specified return. Retirement funds and insurance companies scoop up these bonds, which pay higher interest rates than government paper, but whose default rate is still very low.

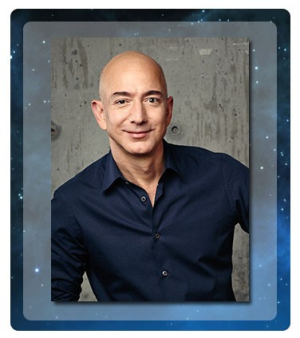

Then, in the middle of the 2000s, Jeff Bezos discovered cash flow.

As with much of what Jeff Bezos discovered, he didn’t invent cash flow. He didn’t even invent the idea of putting cash flow into computers, let alone in capital spending. Walmart still has more operating cash flow than Amazon. Google was the first to learn this one wierd trick.

Google saw how much its search engine was bringing in, it saw the need to scale that globally, so it built its network of data centers with advertising cash flow. Amazon did the same thing. The twist was that Bezos didn’t just seek cloud cash from his store. He decided to rent the cloud capacity he was building, becoming the first cloud landlord.

By the turn of the 2010s, Mark Zuckerberg of Facebook understood the trick. He began putting cash to work in new data centers before he even had the cash. Then Microsoft saw the trick and re-arranged the way it did business to put the cloud first. Then Apple saw the trick, and now services are one-third of its business.

The keys to cloud technology are cheap hardware and open source software that treats the hardware as one machine. The financial key, however, is cash flow.

The Cloud Czars throw off enormous amounts of cash flow and have minimal debt. Companies that looked at the cloud proposition in the traditional way, as something to be bought with debt, just said no to it. AT&T and IBM kept doing business the way they had been doing it before the Cloud. They were ruined by that decision, relative to the Cloud Czars.

It has gotten to the point where the Czars are having trouble finding new things to do with their cash flow. Apple has begun taking over its supply chain. Amazon has started taking over its distribution channel. Facebook is a bigger name in India than the U.S. Both Facebook and Google are in trouble with antitrust authorities because the information they access and store for free now defines most human relations. So far Microsoft has been unscathed, but that won’t last.

When I bought my first computer, back in 1982, I financed the $3,000 purchase and wrote it off my taxes over three years. Today cash flow lets the Cloud Czars spend $4-5 billion each quarter, each, without a qualm.

Cash flow rules the world.