SPACs are the new hot way to go public. Instead of having to file nasty reports with the SEC, or answer hard questions from reporters and the common herd, you just hand the deal over to some hedge fund sponsor, sit back and wait for the money to rain down.

Some of the companies that have come out this way have been good for speculators. Draftkings (DKNG) has been huge. Some, like Virgin Galactic (SPCE) have had nice runs before falling to Earth. Others have been pure dogs. Can you believe WeWork is going public through a SPAC?

SPACs are a way to take money from bankers and put it into the hands of hedge fund sharpies who know how to go on TV and spin a story. The godfather of the movement, Chamath Palihapitiya, admits as much.

SPACs are also a way for hedge funds to dump their garbage. Profitable companies that used to go public now wait until all the juice is squeezed from them, taking bigger-and-bigger hunks of private equity cash. Now the garbage, the companies that aren’t making money, can go public through SPACs.

For the hedge fund guys, it’s a win-win. Get people to invest blind, sell them on your garbage, then on to the next one before “investors” see an earnings report.

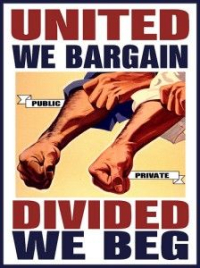

The upper middle-class didn’t worry when their hedge fund masters came for the immigrants, the unions, or the gig workers who clean their toilets. Well, now the .0001% is coming for you.

How does it feel?

Right, so SPACs are apparently a scam: “a way to take money from bankers and put it into the hands of hedge fund sharpies.”

Why are they nonetheless attractive to start-ups? Partly because they “take money from [the investment] bankers” who, in the standard IPO, give away newly minted shares to their buddies in insider deals and set the issue-price low true value to ensure a price “pop” that will enrich all original shareholders: themselves (in addition to the high fees they charge), their aforementioned buddies, the company owners.

That’s also pretty rotten. So what’s the answer, which preferrably channels most IPO rewards to the last-named?

Right, so SPACs are apparently a scam: “a way to take money from bankers and put it into the hands of hedge fund sharpies.”

Why are they nonetheless attractive to start-ups? Partly because they “take money from [the investment] bankers” who, in the standard IPO, give away newly minted shares to their buddies in insider deals and set the issue-price low true value to ensure a price “pop” that will enrich all original shareholders: themselves (in addition to the high fees they charge), their aforementioned buddies, the company owners.

That’s also pretty rotten. So what’s the answer, which preferrably channels most IPO rewards to the last-named?