Everyone is talking about housing prices. (The house on the right is not for sale right now.)

Everyone is talking about housing prices. (The house on the right is not for sale right now.)

Whether you want to buy or rent, they’re too high.

But there’s a simple solution, one that doesn’t require us to build a single new house.

It’s the tax code.

Real estate has huge tax advantages. These were meant to attract homebuyers. But they’ve also attracted investors, both individually and through huge pools of private equity.

The answer is to reduce the advantages, at least for homes that aren’t occupied by their owners. Even a credible threat to change the tax laws would send investors scurrying and home prices falling.

It needs to be done carefully. It needs to be phased in. To those who argue that this would cut the supply of houses, maintain breaks for new construction. The investors will rush over there.

I don’t want to hear any arguments here about capitalism and government takings. Most of the economy is directly impacted by the tax laws. The problem is you can have too much of a good thing. The growth of oil was fueled by the tax law. This is the same thing.

I don’t want to hear any arguments here about capitalism and government takings. Most of the economy is directly impacted by the tax laws. The problem is you can have too much of a good thing. The growth of oil was fueled by the tax law. This is the same thing.

We especially need national action requiring AirBnB. Hotels (and that’s what AirBnBs are) can make more money rented out one-third of the time than an apartment can earn on a yearly lease. That’s a huge incentive for investors to swallow up housing, especially in areas subject to tourism, and kick the residents out.

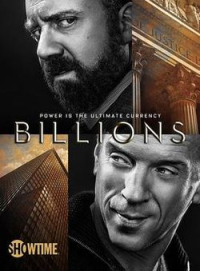

The point is we can do all this if we have the political will to do it. The billionaire class that now controls our lives doesn’t have to be allowed to do that. They do it only through our sufferance, and through their (under the table) activism. Expose them, attack them, make the necessary changes, and everyone benefits.

That’s the through line here.