I’m not a millionaire right now.

I’m not a millionaire right now.

My retirement account is down 25%. I was heavily into tech stocks like Amazon, Microsoft, Apple, and Google. They’re all down. My more speculative investments, companies like Fubo and Cloudflare, are worth less every day.

But I’m lucky. If you’re an American, you’re lucky too. Because what’s really happening is a global market crash.

The best investment for an investor in China, in Europe or in the global south today is the American dollar. Government bonds at 3% look good because the value of the dollar itself is rising.

Over just the last month, the dollar is up 5% against the Chinese currency, the yuan. That’s not being manipulated. The Chinese economy is teetering, thanks to Xi’s lockdowns and his tech crackdown. He has broken the contract that has underlain the state since 1978, slowly rising living standards in exchange for order, and faith in the Communist Party. His resignation, and replacement by someone more business-friendly, could happen at any time.

Over just the last month, the dollar is up 5% against the Chinese currency, the yuan. That’s not being manipulated. The Chinese economy is teetering, thanks to Xi’s lockdowns and his tech crackdown. He has broken the contract that has underlain the state since 1978, slowly rising living standards in exchange for order, and faith in the Communist Party. His resignation, and replacement by someone more business-friendly, could happen at any time.

European economies are in turmoil over Ukraine, now settling into a longer war. That means billions for defense, and billions more to house refugees. It’s a tax on every European which, so far, they’re willing to pay. But you pay for it with lower living standards, in other words a recession.

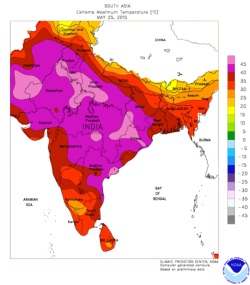

India is baking in temperatures over 120 degrees, which are killing crops and setting the stage for widespread famine. Sri Lanka’s government just resigned because it can’t pay the bills. Africans are falling back into the abject poverty the Internet had just pulled them out of.

India is baking in temperatures over 120 degrees, which are killing crops and setting the stage for widespread famine. Sri Lanka’s government just resigned because it can’t pay the bills. Africans are falling back into the abject poverty the Internet had just pulled them out of.

All these events represent selling pressure. Russians are selling, Ukranians are selling, Asians and Africans are selling (if they have anything to sell), Europeans are selling. The best move I’ve made during this crisis was to sell out of an international mutual fund I’d been in for over a decade.

If you don’t need cash now, hang in. You’re going to get a bottom you can buy. I can’t tell you what it will be, or when it will be, but it will be soon. That’s because the American economy is by far the strongest in the world, and our technology is the reason for that. Nothing cuts costs like cloud applications. They’ve let American businesses adjust to a host of sudden shocks in the last two years, from the lockdowns to supply chain snarls, from rising gas prices to war costs.

Yet American businesses are still hiring. Unemployment is 3.6%. People are getting raises, and they’re spending like mad, anticipating that inflation will make things cost more later.

Once markets recognize this, once it’s reflected in economic data, things will turn around. I can’t tell you when that will happen in the rest of the world, but it’s the U.S. that will lead us out, whenever it happens.