Oil prices have been falling in recent weeks, and analysts have been telling investors to “buy the dip.”

Oil prices have been falling in recent weeks, and analysts have been telling investors to “buy the dip.”

They’re wrong.

The current “energy crisis” is a short-term phenomenon, caused by Russia’s invasion and falling production. Few people seem to comprehend that the falling production has a cause. The cause is a clear understanding that renewable energy prices are coming down.

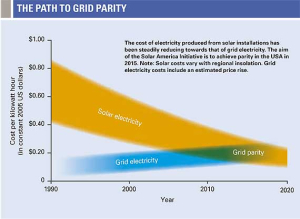

The new buzzword is “grid parity.” The definition is that solar and wind energy equal the cost of fossil fuel energy, without subsidy. That doesn’t just require panels and turbines. It also requires storage, so power levels can be boosted and lowered at will.

We get confused about this because grid parity means different things in different places. An extensive grid, and ample power infrastructure, means it takes a lower price to achieve grid parity. In many countries solar reached grid parity years ago. It’s starting to achieve that in China. Once you achieve grid parity, replacing fossil fuel power with renewables is a simple matter of scaling up.

We get confused about this because grid parity means different things in different places. An extensive grid, and ample power infrastructure, means it takes a lower price to achieve grid parity. In many countries solar reached grid parity years ago. It’s starting to achieve that in China. Once you achieve grid parity, replacing fossil fuel power with renewables is a simple matter of scaling up.

Berkshire Hathaway is getting a lot of stick right now for slowly buying Occidental Petroleum. Berkshire owns a lot of electric utilities, and long-distance capacity. The assumption is that, by buying a fossil fuel provider, Berkshire is signaling that renewables can’t achieve grid parity.

That’s wrong. Berkshire already buys a lot of solar, and a lot of wind energy. Occidental will create a cost ceiling. It can then manage the transition to renewables without disruption to its customers. As they scale, it will just sell more of its gas. It will subsidize its natural gas use by selling Oxy’s oil, which comes from the Permian Basin and is relatively cheap.

If you don’t believe in renewables, you certainly believe in nuclear. We’re about to add a bunch of nuclear capacity here in Georgia. That’s another thumb down on fossil fuel prices.

Today’s “energy crisis” is a transition period. It’s not permanent. As renewables achieve grid parity, then scale up, they’re putting a thumb down on energy prices and, as electric car production scales, on transportation costs as well. This is what I was talking about 3 years ago when I wrote about “the end of oil.” “The fall of oil will be as sudden, as catastrophic, indeed as violent as its rise has been. Autocrats don’t take threats to power lying down,” I wrote then. It is proving to be just that, but it will pass. It will pass surprisingly quickly.