Fed chairman Jerome Powell is basing his anti-inflation fight on the success of Paul Volcker from 1979-1984.

Fed chairman Jerome Powell is basing his anti-inflation fight on the success of Paul Volcker from 1979-1984.

What if it’s wrong?

I had already begun my reporting career in 1979. Volcker’s policy did cause pain. But interest rates didn’t start falling until the 1980s, and the Fed wasn’t the only cause.

The other cause was the State Department. In 1981 the Reagan Administration quietly negotiated an alliance with the Saud family based on a simple premise. They would sell oil in dollars and pump a lot of it. We would extend to them our military protection, specifically against Iran.

That alliance has held firm from that day to this. It held firm through the Gulf War. It held through 9/11, even though the attack was committed mainly by Saudi nationals and inspired by the son of a Saudi billionaire. It held through the disaster of Iraq.

It was this alliance that sent inflation down in the early 1980s, not Volcker’s Fed. Oil went from over $125/barrel to $80 in Reagan’s first term. Texas’ economy was crushed, but everyone else prospered. It was morning in America.

Our present inflation is also based on resources. Oil costs spiked from $80/barrel last September to over $115 in May. They’ve since fallen back to $80. The fall came about because we’re no longer in an economic era defined by resources.

Today money rains down from the clouds. Tech stocks are hurting, but the best build on cash and cash flow, not loans. Technology delivers productivity, it delivers value, and this extends in every direction.

Technology already installed means our economy adjusts to change far more quickly than it did in the 1980s. Fed policy is designed to take effect in months and years. Tech lets businesses adjust on a dime. Economic changes regulate business behavior much faster than the Fed can.

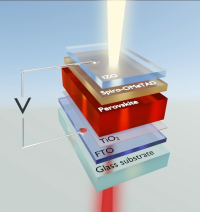

Technology’s reach is extending now into those resources the war impacts directly. Solar energy now costs less than $1/watt. The price is continuing to fall while natural gas prices rise. The costs of wind energy also continue to fall. If you’re buying energy on a five-year contract, you’re a fool to buy fossil fuels.

We’re already seeing declines in the price of commodities. Supply chains are loosening, so transport costs are going down. Consumers are becoming normal again. Win the war in Ukraine and our biggest problem becomes deflation, with a huge new opportunity to save money on food and water, again using new technology.

Technology can whip inflation now. If Powell pays attention to the data, he will realize this within a few months. Then you can worry about a “chip glut,” cheap silicon for cheap machines making the next boom bigger than the last.