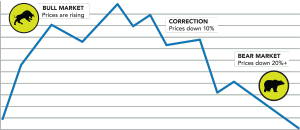

The time to buy a bear market depends on your time horizon and your risk appetite.

The time to buy a bear market depends on your time horizon and your risk appetite.

If you’re in your early 30s, for instance, it’s a great time to buy the U.S. stock market. Stocks are at pre-pandemic levels, including some companies that still have great growth prospects. Most of the Cloud Czars fall into this category, as well as cloud applications like Salesforce.

If you’re in your late 60s, like I am, you should probably hold off. You still want to maintain enough cash to get through if things turn south, as the ultra-bears insist that they must. But ultra-bears are wrong. Markets do bottom, and they do go back up. If we’re about to have nuclear winter, cash won’t save you.

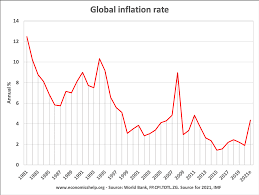

My own view is that a new bull market will start once investors are convinced that inflation, thus interest rates, are peaking. There’s an argument to be made for that, but not everyone is convinced.

My own view is that a new bull market will start once investors are convinced that inflation, thus interest rates, are peaking. There’s an argument to be made for that, but not everyone is convinced.

If inflation is peaking, conservative investors and olds should look first to bonds, whose value will rise as inflation slows, and which at least offer a return. The two year bond looked especially tasty on October 17.

Those with “risk appetite” might want to start fishing around companies heavily into the Machine Internet and DNA research, knowing that not all will succeed. Maybe start with some ETFs if you don’t have time to find them on your own.

It’s still too early to get into the highest risk companies. Many will be merged away at super-low prices in the coming weeks. But you can buy this market. Even if we haven’t seen the lowest low, we’re close enough that I’m not worried about it.

You’re not going to get rich fast from here. As the dollar falls, which it needs to, foreign investors will be selling into strength. There is still money that believes in Armageddon, although what they’re doing here is beyond me. Retirees continue to retire, which means folks like me will start selling steadily over the next few years.

Here’s the bottom line. I may be wrong, but I think we’re going to be OK.