We all know about the bear market in stocks, down over 20% from their peak. Bond investors are also down over 15%. Real estate is rolling over. This is where capital gets its money.

Meanwhile, ordinary Americans are doing OK. It’s true that inflation is outpacing wage gains, but there are wage gains. Jobs remain plentiful. Last year’s stimulus was mainly aimed at firming incomes. More relief is coming from the Inflation Reduction Act.

This has created pure fury on Wall Street. I follow financial Twitter for my job, and the anger is palpable. Investors are predicting the imminent downfall of the whole economy. They’re demanding that the poor pay the penalty for their mistakes with money. They really can’t get their heads around the current situation.

Some of that was necessary. Some of it was not. As the economy recovered last year, prices rose because there was too much money chasing too few goods. Russia’s war in Ukraine, and the tilt of China and India toward an aggressive and tighter autocracy, made it worse. There’s global inflation and a global recession coming.

The response by the Federal Reserve is to make money cost money and have less money. They told investors this would happen, loudly and clearly. They have followed through. Because 2 is twice 1, and 4 is twice 2, the rate of financial tightening is higher than it has ever been. What’s called “quantitative tightening” is reducing the supply of funds to invest, and that has also hurt investors.

Ordinary people have it better. There’s competition for labor. The government safety net is expanding. There’s even a small thumb bearing down on drug costs, at least for generics like insulin.

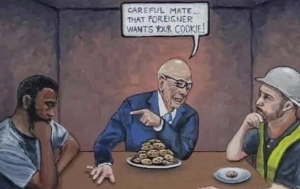

The Republican party has always been the party of investors, although in recent years it has also become a party of fascists, religious zealots, and conspiracy theorists. Their policies will always favor investors over everyone else. This has been true since the Grant Administration. As the cartoon puts it, the rich seek to make those with something hate those with nothing.

The Wall Street Revolt is just one piece of the crisis we’re going through now. But it’s an important piece. I hope it’s not the decisive one, because the backlash against it would threaten us all.