The truth about macro-economic prediction is this.

The truth about macro-economic prediction is this.

No one knows anything.

Empirical macroeconomics is in its infancy. The first macro book based on real data I can recall is Thomas Piketty’s Capitalism in the 21st Century. Because the author’s conclusions were considered liberal, it was largely ignored.

Economics since Adam Smith has mostly been witchcraft. It has been based on feelings, on assumptions, in short on ideology. Economists have decided this is the way it must be because their bosses say so, then they twist reality to fit the theory. The assumption is that when prices rise, suffering must follow. The only way to get good times is by giving people hard times. (Not economists, of course. Never economists. Little people, working people, poor people. Other people.)

Most of what we “know” about how economic systems work is bunk. Capitalism only works in practice, as billions of people buy, sell, make, and trade with each other. But practice offers nothing to moralists.

Most economists are politicians, or if not they work for them. And almost all politicians are moralists of one sort or another.

This divergence has become both obvious and obnoxious. Countless economists keep predicting an imminent recession. Some think it will be very bad. Reality refuses to cooperate.

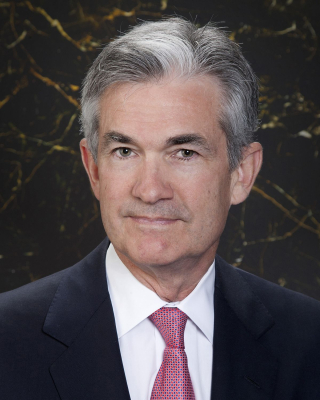

The Federal Reserve says it is “data dependent,” and the data it’s looking at is prices. Those prices are increasing, but at slow and slower rates. The economy, meanwhile, keeps rocketing along. Why?

Rich people have been caught offside by all of this. Last year’s tech wreck caught them by surprise. So did this year’s stock market recovery. I’ve had a simple strategy, do nothing. I’m fine.

There remains trouble ahead. What happens when food disappears , as it will under the relentless pressure of climate change? The world is on fire while economists and policymakers continue to act like this is fine. But that’s got nothing to do with the latest economic predictions, which are all based on fairy dust.

I am tired of the economics of fairy dust, and I’m tired of economists who see everything through a moral or ideological prism. Follow the data and ignore “experts” who don’t.