I have been covering renewable energy since 2010. One thing I know for certain is that equipment suppliers haven’t made much money from it.

I have been covering renewable energy since 2010. One thing I know for certain is that equipment suppliers haven’t made much money from it.

Solar panels and windmills are the engines of renewable energy. They harvest electricity from the Sun and the wind, just like car engines harvest the energy of fossil fuels.

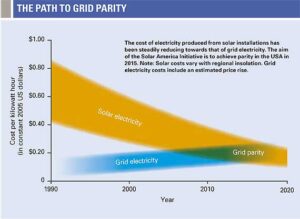

But with renewables, costs are always declining. The value of a solar panel bought today, based on its energy output, is much greater than one purchased a decade ago. People who bought the old panels based on a 30-year life are feeling ripped off.

This will continue. Maybe you think of panels today as 10 year property. Well before 10 years are up, newer designs will make them 3 year property. Then 1 year property.

Deflation is a hard reality for capital goods makers to grasp. But this is what Moore’s Law does.

Solar equipment and windmills don’t decline in price based on Moore’s Law. But science and engineering get better and better, faster, and faster, as the equipment built on Moore’s Law goes into service, and as software is absorbed by users. This means faster scientific discoveries, faster engineering processes, and faster cost reductions.

Anyone who has ever bought a computer, or a smartphone, or any piece of chip-based equipment understands this. Back when I started as a reporter, companies routinely wrote down their tech investments over 10 years. It was a capital good. Now we expense it all, even though we know the machines will run fine until they become obsolete.

Clouds are seeing a reversal right now. That’s because Nvidia chips cost more than the Intel chips they replace. In response, the Czars are giving their gear a 5-year useful life, instead of a 3-year life. That will change as Nvidia’s costs come down, and as competition within the AI industry grows.

But energy remains a capital industry. Renewable energy take-up is controlled by utility companies. They have yet to adapt to the deflationary reality.

As a result, every year or two we get hand-wringing articles about the collapse of solar and wind energy. We’re getting that now, because money is costing more, thus utility budgets are out of whack, thus they feel a need to cut back.

The answer is to do what companies did in the 1980s, to write off equipment faster. Take the money you’re saving in generating electricity from panels and windmills, and put it toward shortening depreciation, into amortizing equipment faster.

Soon you’ll be able to just pay with cash and expense the purchase for a quick return.