This was the heyday of Dell Computer, which solved the problem by building computers to order. The machines were customized, assembled as parts, and never saw a store shelf, delivering maximum value to their maker.

This was an early case of Moore’s Law outrunning manufacturing. It takes money and organization to build a plant to make anything. But if the final product’s value is constantly declining, your margins disappear without notice.

Tesla Obsolete?

Tesla Obsolete?

Tesla is facing that problem right now. It has billions of dollars invested in lithium-ion batteries. Two years ago, it claimed to have achieved a long-lasting market advantage from how it packs these batteries.

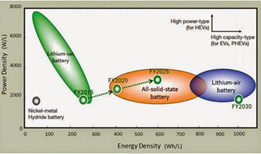

But Moore’s Law changes everything. Using the latest computers and networks, scientists and engineers advance quickly in every direction. Semi-solid batteries are already being mass-produced in China. Solid state batteries are coming. They promise greater energy density than lithium-ion, thus greater range. They’re safer, too. Which means many of today’s big lithium investments are going to be wasted.

Scaling production requires a big investment, but science and engineering can make that investment obsolete quickly. This will burn the Biden Administration badly in the next few years, as investments in big batteries and big cars powered by them turn out to be sub-optimal. In the era of Moore’s Law, we must change the way we think about moving science into production. Get your investment out quickly or you may not get it out at all.

Tesla Obsolete?

Tesla Obsolete?