Over the last two years inflation has fallen from about 9% to about 3%.

Over the last two years inflation has fallen from about 9% to about 3%.

But the last mile toward the Fed target of 2% is going to be tough. Because most of the remaining inflation is caused by things the Fed can’t begin to deal with.

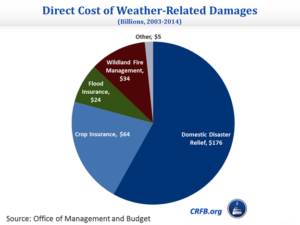

Take climate change. Insurance costs are through the roof, especially homeowners’ coverage. We have known for years that hurricanes and rising seas will destroy homes by our coasts, but that’s coming home now. In trying to make insurance affordable for more people, insurers are raising prices for everyone. (This chart is nearly a decade old.)

Then there’s war. War is unhealthy for economies and other living things. President Biden is stuck between the rock of Netanyahu and the hard place of Ukraine’s need. All the arguments used on behalf of Israel’s actions are turned against us by Russia. End the wars and the peace dividend will be massive, but we can’t do it on Putin’s terms. It won’t end on Netanyahu’s. As with Bush and 9/11, he’s just set the next war in motion.

Cars and Housing

Then there’s housing. We need more homes, especially 1 and 2 bedroom homes, but we can’t build them because local governments reject them. It will take years to convert office buildings to apartments. That’s not the Fed’s fault. Lower interest rates won’t solve the supply problem.

Despite this, expect inflation to play a major role in elections. Don’t expect reality to be a good enough answer for the business media.