There are now four Cloud Czars, not five. Apple is opting out of the GenAI frenzy.

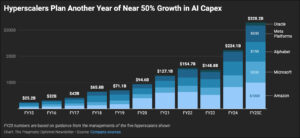

Apple’s announcement of “Apple Intelligence” last year was a head fake. I noted at the time they were rejecting “Big AI,” and they haven’t changed their minds. Apple’s capital spending this year is expected to be $11.5 billion, a tiny fraction of what Microsoft, Google, or Amazon will spend.

So far, the stock hasn’t suffered for it. The only one of the “Big AI” stocks to have taken off is Meta, up 18%. Apple is down slightly, but its performance is very close to those of the other Czars.

Apple is putting its money into maintaining and maybe growing its iPhone share. The launch of a cheaper iPhone 16e from an Indian factory drew little notice here, but a lot there. The lower end of the phone market has been dominated by Google’s Android for years, and it now has 77% of the total. Huawei’s Harmony OS is said to be Android-compatible, with 4% of the market.

The Apple Strategy

It claims a “partnership” with OpenAI but there’s nothing it can’t get out of. Apple is focused on building models that can run directly on its clients, as opposed to larger models that require an online connection.

Given that the large models aren’t getting better fast and continue to hallucinate, even after considerable use, this looks like a sound strategy. Given the size of the phone market, any gains from Android will mean big money, and the Indian manufacturing base could bring such gains in the Middle East and Southeast Asia, where economies are growing and where many countries are at relative peace, such as in Vietnam.

This means that when the GenAI market crashes, as everyone is predicting it will, Apple shouldn’t. It is independent of the madness, and I wonder why more analysts aren’t pointing this out.